Now, Online Banking Will Show Holds and Transactions

10/5/2020 1:00:00 PM

Looking for more information? Read on for answers to some of your frequently asked questions:

What is a debit card authorization?

Many merchants process debit card transactions in 2 parts – an authorization and the completed transaction. Most common when you use your signature instead of your PIN for a transaction, this type of authorization also often shows up for restaurant and gas purchases.

The authorization is considered a “hold” on the funds in your account to assure payment to the merchant.

How will these debit card authorizations – or holds – show up online?

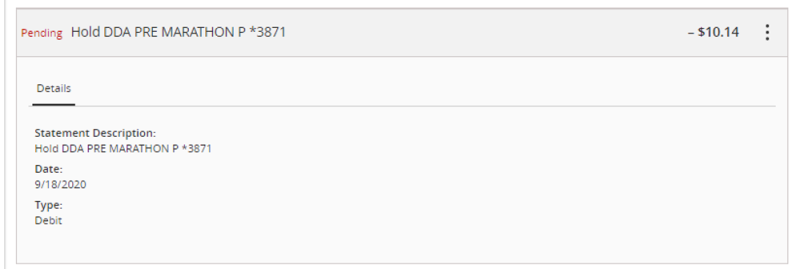

Holds appear with the rest of your account transactions in online banking and have “Pending Hold” in front of the merchant’s name.

Why is the pending hold not for the amount of my actual transaction?

Sometimes merchants authorize your card for a different amount than when your transaction is completed. For example, restaurants may authorize your card for the amount of the bill or the amount of the bill plus an estimated tip, but the actual amount may be different after you leave your tip. Or when you use your debit card at a gas pump, the merchant does not know how much gas you will fill, so may authorize anywhere from $1 to $175. (This should be disclosed through signage at the pump.)

How do I know when the hold will be removed?

You can click or tap on the pending hold transaction to view a date field. The date is the last day the hold will remain in place. The pending hold will also switch to a normal transaction as soon as the merchant completes the transaction – it will not show up twice.

Why do these holds impact my account’s available balance?

This is done to let you know how much money you have available on your card to spend. When a merchant places a hold on your account, they are guaranteed those funds when they run it at a later time. This amount can change, drop off or be processed at a later time. In rare situations, such as when a merchant has a processing issue, the amount can change even after the hold drops off. (Effective for debit card purchases made Oct. 7th and going forward).

What if a hold was placed on my card, but I decided to pay through a different method?

This is common at hotels if you use one card to check in but check out with a different card. If that happens, ask the merchant to remove the hold from your card.

What is a new account hold?

For new bank customers, new account holds may be placed on check deposits that are not drawn on a Bell Bank account. This may apply for the first 30 calendar days the new account is open. The holds are released 5 business days from the date of the deposit.

Why does my mobile deposit show up as a hold?

Sometimes, mobile deposits may have an additional hold placed on them while they are processing or being reviewed. These holds often last 1-3 days for checks with larger dollar amounts.