Navigating Uncertainty: The Challenges Facing Ag Producers and Agribusinesses

6/12/2025 1:00:00 PM

In an era of fluctuating markets, shifting policies and persistent economic pressures, agricultural producers and agribusinesses are once again navigating a difficult economic environment. From the ripple effects of tariffs to the burden of deficit spending and inflation, the ag sector is forced to adapt to shifting financial realities while striving to maintain stability and growth.

Let’s dive deeper into the key challenges facing farmers, ranchers and producers today.

Tariffs and Trade Uncertainty

Agriculture, perhaps more than any other industry, is deeply intertwined with global trade. The imposition of tariffs on key exports has reshaped market dynamics, forcing producers to rethink traditional strategies. Tariffs on agricultural commodities have led to retaliatory measures from trading partners, affecting the profitability of U.S. farm products abroad. Agricultural producers are seemingly always on the front lines of these economic disruptions.

While government ad hoc disaster programs have offered temporary financial relief, the long-term sustainability of such interventions remains uncertain. Moreover, it’s unclear if the political will – or money – will be there year after year should the negative effects of tariffs continue to impact producers.

The lack of predictable trade agreements can make long-term planning difficult, requiring producers to adopt more agile financial strategies to withstand market disruptions. As much as possible, producers reliant on export markets may need to explore value-added products and seek out new trading partnerships to mitigate associated risks. This theme – of being able to call an audible for your operation when faced with uncertain conditions – is one that I’ll discuss in detail at our AgViews Live seminar in July.

Deficit Spending and Policy Uncertainty

The U.S. deficit is now approaching $37 trillion. In May, Moody’s downgraded the U.S. credit rating for the first time in history. Interest on the national debt is projected to be an astronomical 30% of revenue by 2035. The U.S. debt to gross domestic product (GDP) is about 122% — up from 62% in 2007. As federal spending and the debt increase, questions about long-term consequences — such as inflationary pressure, interest rate hikes and reduced government support programs — loom large for agricultural businesses.

Increased deficit spending can drive up borrowing costs, making it harder for farmers to access affordable credit for operational expenses, equipment purchases and expansion plans. Additionally, a ballooning federal deficit with large required mandatory spending leaves little money for discretionary farm programs like crop insurance and disaster relief.

Inflation and Rising Costs

Rising costs have created a significant financial strain across the country, leaving businesses with shrinking profit margins. The agricultural sector, already vulnerable to tight margins, is seeing substantial price hikes across essential inputs. The costs of fertilizer, chemicals, seed, fuel, repairs and labor are all higher. Input costs for producers have increased by about $90 billion since 2021.

Another point to consider: At the retail level, inflation impacts consumer purchasing habits, affecting demand for certain agricultural products. Higher grocery prices may shift consumer preferences toward cheaper alternatives, creating volatility for producers reliant on price-sensitive markets. For example, is it reasonable to think most consumers can continue to pay $6 per pound for ground beef?

Moreover, these macroeconomic factors will undoubtedly continue to drive consolidation at all levels, from individual farm operations to large businesses that support agriculture. For example, in banking, consolidation has led to the four largest banks in the U.S. having a whopping $11.9 trillion in assets. To put that in perspective, the 4,300 banks under $10 billion have a combined $3.4 trillion in assets. Are large banks too big to fail?

Farm Performance in 2024

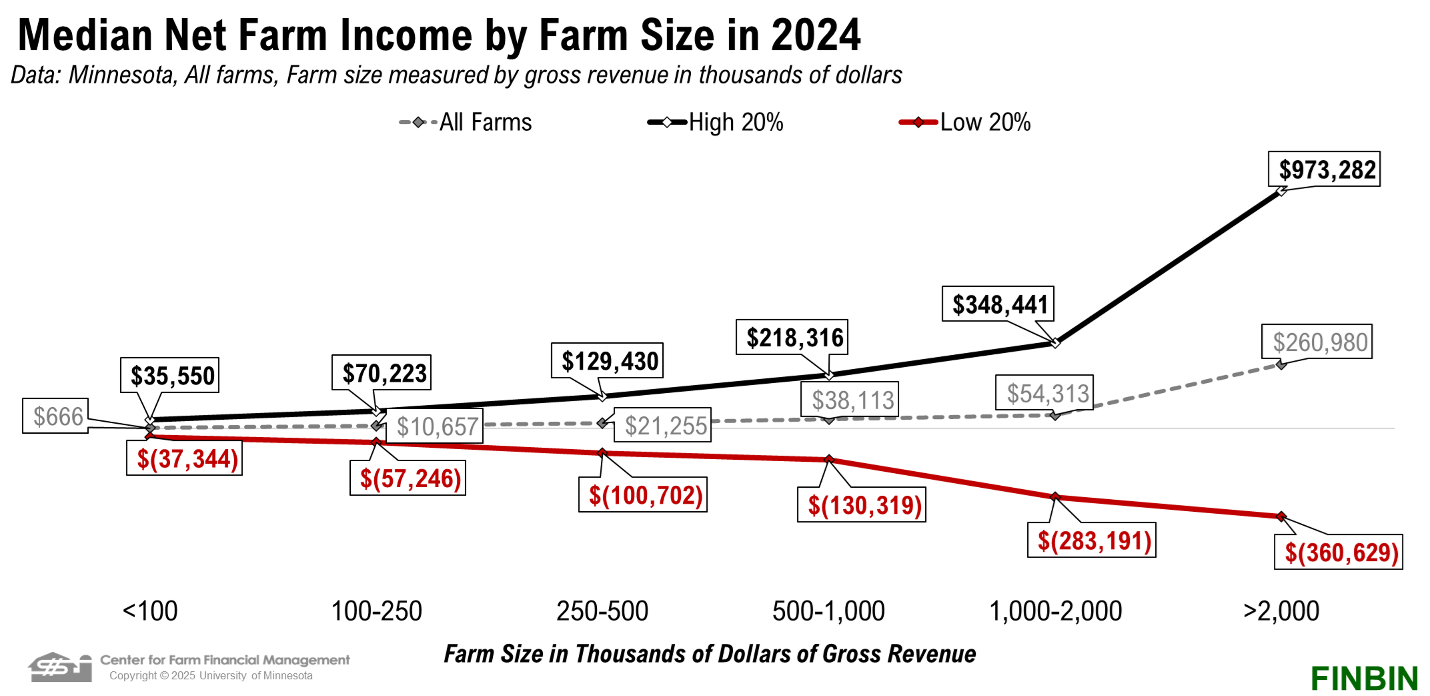

In the face of all these challenges, how did farm and ranch operations do in 2024? The Center for Farm Financial Management chart below, which shows median net farm income by farm size, gives us an idea. This data set includes producers from all ag sectors, and shows how, as operations grow larger by gross revenue, there is a wider profitability spread between the top 20% and the bottom 20%. Bigger isn’t always better. From a historical perspective, the 2024 chart is an accurate reflection of the variability in farm sector economics.

There is currently a bifurcated farm economy. Grain or row crop producers are generally feeling stressed with commodity prices down 30%-40% over the past 2-3 years, while input costs, as noted earlier, have continued to increase. On the other hand, livestock producers – especially established cow and calf producers – are mostly faring well. I noted in a previous newsletter that the steer I bought last year cost me about $4,000 (including processing). I’m guessing it will be up another $1,000 – to about $5,000 – this year.

When taking a forward-looking view, it’s hard to plan. Is it reasonable to assume we’ll have a status quo with farm policy, no ad hoc government payments, no supply shock and no change in consumer behavior? Unfortunately not. Instead, remember the “CTC” principle – control the controllables.

From an ag lender’s perspective, here are a few thoughts and observations on the state of the ag economy:

- Breaking even financially in 2025 and maybe in 2026, especially for grain crop operators, could be considered a win.

- Producers need to be cautious about the mindset that “the government will take care of me.” One needs to assess how an operation will do without these ad hoc payments.

- A number of producers replenished their working capital levels around 2014-2020 by refinancing real estate. Most of these loans and payments are still on financial statements.

- Look for lenders to have more loan covenants or agreements with the expectation that the borrower will be held accountable for understanding and complying with the additional agreements.

- Following profitable years, some lenders may have loosened their credit standards and underwriting requirements. Watch for those to be tightened back up.

- Lenders often use risk ratings in their portfolios to assess overall credit risks. Look for risk ratings to slightly deteriorate in ag portfolios. However, the overall credit risk in most lenders’ ag portfolios continues to be very manageable. Past due loans are at reasonable levels.

- Farmland values remain firm and leverage is steady, despite recent pressures on the ag sector coupled with increased debt.

- While overall profitability and liquidity may be stressed in some cases, farm operations are generally not going bankrupt. Many are asset rich and cash poor.

- What is the quickest way to fail at farming? Ignore your finances. To quote finance expert Dave Ramsey: “If you don’t stay on top of numbers associated with your business, you will fail. You can’t outearn disorganization or the need to handle your finances wisely.”

- Agriculture has always been a cyclical business. Often, risk perception becomes the cloudiest at both the high and low points of the cycle.

- Don’t sleep on the benefits of off-farm income. A 2023 study from the American Farm Bureau Federation found that only 23% of farm household income came from the farm/ranch. A whopping 77% came from off-farm sources. Moreover, 72% of off-farm income was earned income (income earned from work or time), while 28% was passive income (Social Security, pensions, interest income, etc.). The fringe benefits of off-farm income – health insurance and pensions being the largest – are substantial.

As we move forward, it will be crucial to stay informed on economic trends, embrace adaptive strategies, and foster collaboration within the industry. The future of agriculture will be shaped by those who recognize both the risks and the opportunities inherent in today’s economic landscape.

This article appeared in the Q2 2025 issue of Bell’s AgViews newsletter.

Lynn Paulson

SVP/Director of Agribusiness Development