Economic Outlook August 2025

8/14/2025 1:00:00 PM

Forecasting can be very difficult, because you are trying to predict something that will happen in the future using only the limited data available to you. In the case of interest rates, there is a lot of energy that goes into predicting if or when the Federal Reserve will adjust short-term rates. There is noticeable influential pressure from outside of the Fed’s normal economic models looking to drive policy rates lower.

When the Fed settles on a short-term interest rate level, the goal is to be at the “neutral rate.” For Star Trek fans out there, the “neutral rate” is like the “neutral zone,” the buffer between the territories of the United Federation of Planets and the Romulan Empire. The Fed’s neutral rate is a balance between maximizing employment and stable prices.

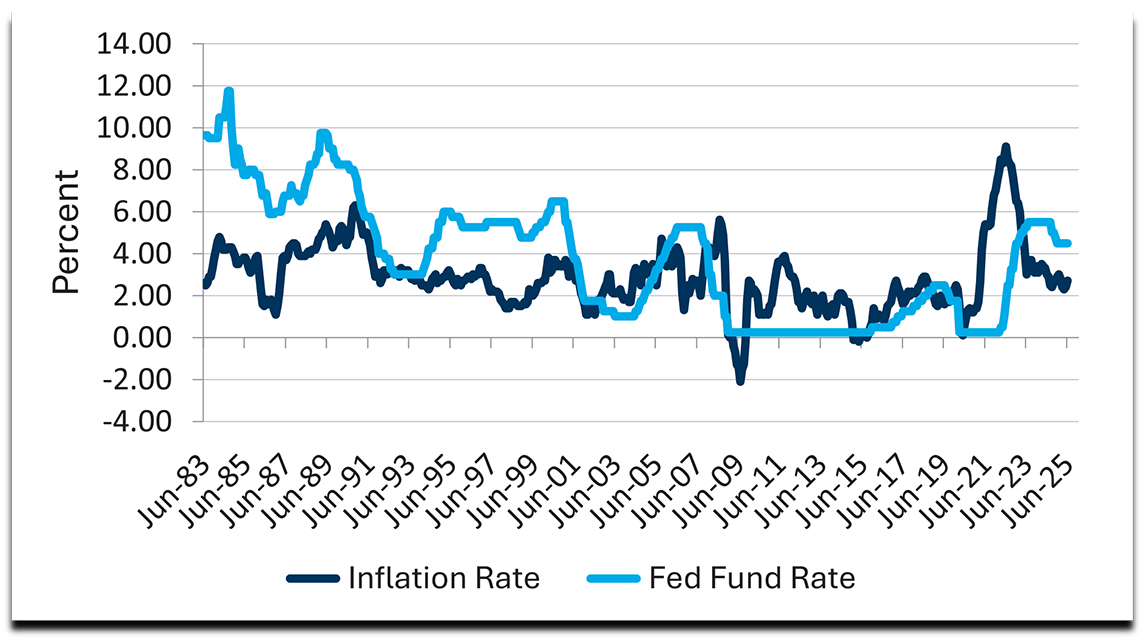

The chart above shows how the fed funds rate is normally higher than the underlying inflation rate. It is only during times of economic stress that the fed funds rate dips below the inflation level. Average inflation over the period covered in this chart was 2.85%, while the average fed funds rate was 3.75%. This would suggest the “neutral rate” is about 1% above the inflation level.

At the time this article was written, the inflation rate stood at 2.7%. This indicates a fed funds rate around 3.7% would be neutral. The longer-term average suggests the Fed has room to cut the current range of 4.25% to 4.5% down to a level closer to about 3.75%. So, what is the hold up? The Fed appears to have concerns about inflation. The Fed interprets economic data as showing the labor market remains stable while the prospect of inflation remains unknown due to the influence of tariffs.

What makes this all so tough to predict? It comes down to the timing of “long and variable” lags between changes in data and changes in the fed funds rate. In other words, how closely they can be aligned. This is the voodoo part the Fed aims to get correct. Reduce rates too early and it risks rising inflation. Reduce rates too late and it risks rising unemployment. Economics is known as the dismal science because it lacks immediate correlation like physics or math.

Distilling this all into a usable conclusion, long-term averages suggest the next move of the fed funds rate will be lower.

There have been many suggestions that a lower fed funds rate will mean lower mortgage rates. Unfortunately, that relationship is far from certain. While the Fed controls short-term interest rates, the market controls long-term rates. If the market believes the Fed cut rates too early, longer-term rates could rise. If the market believes the Fed cut rates too slowly, long-term rates could decline.

I do not mean to add confusion on top of chaos, so perhaps it is best to say this is another topic we consider in our asset allocation decisions when building client portfolios.

Thank you for your confidence in Bell!

Greg Sweeney, CFA®

SVP/Chief Investment & Economic Strategist

Products and services offered through Bell Bank Wealth Management are: Not FDIC Insured | No Bank Guarantee | May Lose Value | Not a Deposit | Not Insured by Any Federal Government Agency