Economic Outlook June 2025

6/2/2025 1:00:00 PM

Is there any benefit to an economic forecast that lasts 73 minutes before reversing itself? Two headlines were generated on the same day, April 9, by the economic research department of a respected investment bank. The first headline occurred at 12:57 p.m. and read, “Moving to Recession Baseline.” Seventy-three minutes later, at 2:10 p.m., the new headline was, “President Trump Announces 90 Day Pause; Reverting to Our Previous Non-Recession Baseline.”

My intention is not to criticize the material produced by this economic research team. Instead, I’d like to provide perspective around the information that bombards investors every day. Did these two headlines work investors into a panic, provoking calls demanding that their representatives realign portfolios and brace for recession – only to call back 73 minutes later with requests to reverse that realignment? We hope not.

This type of occurrence is what investment managers refer to as a cyclical or short-term theme (the example given is the shortest I’ve seen). Our job is to look through the collective nature of near-term themes and develop a longer-term, secular outlook that supports a more consistent approach to reaching long-term investment goals. This approach avoids the erosion in portfolio returns that results from “zigging and zagging” at the wrong time, incurring trading costs and paying unnecessary capital gains taxes.

Currently, the themes in the news have a “government” tilt to them and include federal budgets, deficits, debt levels, taxation rates, wasteful spending and tariffs. All of them are painted with the broad brush of being detrimental to the economy, and any decision made will be bad one.

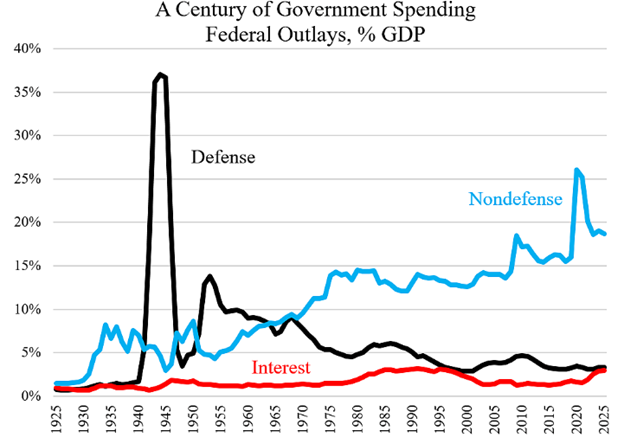

This graph from the Cato Institute breaks government spending into three categories and shows them as a percentage of the U.S. gross domestic product (GDP). There are spikes, such as the increase in defense spending during WWII and the stimulus spending in the wake of the pandemic – but if we look at a historical average without the spikes, it appears federal government spending makes up about 25% of GDP.

When it comes to the economy, the consumer is the alpha dog, making up two-thirds or 67% of GDP. That figure would be even greater without government spending. After all, government spending is funded with money in the form of taxes taken from the consumer. These taxes reduce the amount of money the consumer can spend (or save). So, does it make a difference if the consumer spends (or saves) money, or the government spends money? From an economic perspective, consumers and securities markets (investments from saving) are more efficient allocators of capital.

To get some idea of how the economy might develop, let’s direct most of our attention to the consumer. Total employment in the U.S. is at a record 164 million people. Disposable personal income is at a record $22.361 trillion. Unemployment is at an average of 4.2% over the last 12 months. Continuing unemployment claims at 1.9 million are at the high side of the range over the last 12 months. Job openings are 7.2 million, which is the lower end of the range over the last 12 months. Household debt as a percentage of disposable income is 92.25%, compared to pre-pandemic at 97%. About two-thirds of this is home mortgage debt, and the portion represented by consumer credit is trending lower.

Overall, the consumer appears to be in good shape, suggesting the primary driver of economic growth is in stable condition. The Federal Reserve has the same assessment and seems reluctant to reduce the fed fund rate and risk another bout of rising inflation.

Our outlook is for GDP to grow, but at a more muted pace than the recent past as pressure to reduce government deficit spending could slow GDP a bit. The prospect of a “black swan” – an unexpected event that alters expectations at least temporarily and disrupts investment markets – is always lurking in the background. This is when an experienced, steady hand on the wheel gets through the turmoil.

Thank you for your confidence in Bell.

Greg Sweeney, CFA®

SVP/Chief Investment & Economic Strategist

Products and services offered through Bell Bank Wealth Management are: Not FDIC Insured | No Bank Guarantee | May Lose Value | Not a Deposit | Not Insured by Any Federal Government Agency