Economic Outlook January 2025

1/6/2025 2:00:00 PM

As I sit at my desk on the last day of 2024, I’m looking at the popular S&P 500 Index. It’s defined as a broad-based stock index that tracks the performance of the 500 largest U.S. public companies and is intended to serve as a proxy for the entire stock market. Investors and analysts use the S&P 500 to compare individual stocks’ performance and gauge the broader economy’s health. Today, I am questioning the accuracy of this definition.

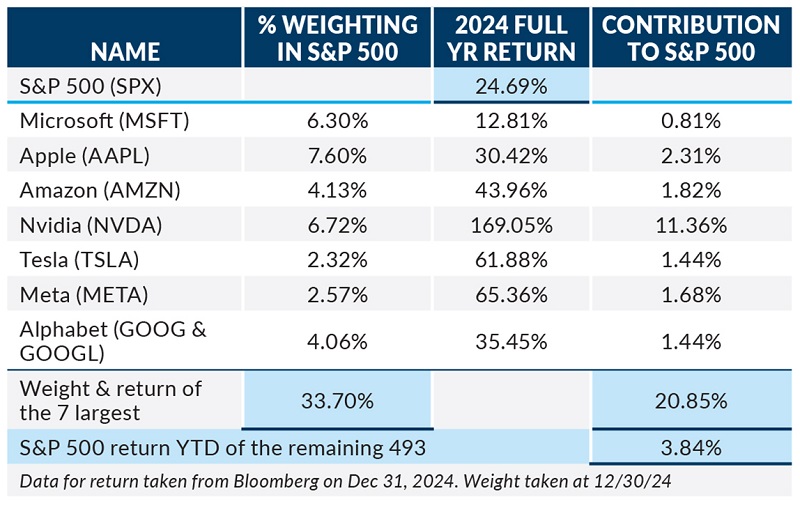

As it currently stands, seven of those 500 companies make up 33.7% of the total market capitalization of the index. That type of concentration is a long way removed from the definition of a broad-based, total stock market concept. The performance of these largest companies further distorts the stated purpose of the index. In 2024, the total return for the S&P 500 was 24.77%. The seven largest companies made up 20.85% of the return, with the other 493 accounting for 3.84% of the return. Again, hardly a proxy for the index’s intended purpose.

Perhaps we could more accurately define the current S&P 500 as a highly concentrated, narrowly defined index that emphasizes the performance of its largest components, while masking the results of most of the other companies in the index. Clearly, we should be evaluating the health of our broader economy using other (or additional) means.

It may help to define exactly what is being communicated when we hear about the “market” being up or down. News about the “market” tends to be about a particular index – often the S&P 500. As I’ve just outlined, that’s quite different from the “market,” which is actually an amorphous entity encompassing thousands of companies.

While this illustration supports diversification among asset classes, sectors, styles and countries of domicile, it also shows how difficult it is becoming to compare and analyze a diversified portfolio against a particular index like the S&P 500.

Did a diversified equity portfolio with a return of 8% do well compared to 493 stocks in the S&P 500, or did it do poorly when compared to the top seven stocks in the S&P 500? With a single stock accounting for more than half the return of the top seven companies, I would say a diversified portfolio with a return of 8% did well against either comparison.

Happy New Year and best wishes for a great 2025!

Greg Sweeney, CFA®

SVP/Chief Investment & Economic Strategist

Products and services offered through Bell Bank Wealth Management are: Not FDIC Insured | No Bank Guarantee | May Lose Value | Not a Deposit | Not Insured by Any Federal Government Agency