Economic Outlook April 2024

4/3/2024 1:00:00 PM

It is human nature to view recent happenings and extend them into the future. This is also the case for investment markets, regardless of whether we are in a declining or rising market environment.

The first quarter saw the popular S&P 500 index rise by 10.55% while the Dow Jones Industrial average increased 6.14%. Three months into the year, those are very attractive numbers. If things keep going this way, the S&P 500 will be up 42% for the year, and the Dow will be up 24.5%. How great would that be?! Consistent with what we said about human nature, this is the math in the back of many investors’ minds right now. However, it should be noted: If the seven largest positions are removed from the S&P 500, the return drops to 3.93%.

Crowd mentality noticeably impacts behavior. This phenomenon occurs when individuals adopt the beliefs, behavior or attitude consistent with a group, frequently at the expense of their own judgment. Crowd mentality can be observed in aspects of daily life, fashion trends, investment decisions and even political thinking.

Some readers may recall their parents asking, “If your friends jumped off a bridge, would you jump, too?” They essentially (and wisely) collapsed crowd mentality into a single statement: Remember to think for yourself.

In investing, thinking for yourself can be hard to do. When a crowd of investment dollars focuses on seven stocks making up nearly 30% of the S&P 500 market cap and 62% of the return year to date, the price goes higher. Does that mean these seven stocks are a good value? Regardless of their relative value, the volume of money invested by the crowd will overwhelm the independent valuation assessment from a few asset managers who think otherwise. Just as a crowd of investment dollars going into a few stocks drives the price higher, a crowd of dollars coming out of a few stocks will push the price lower.

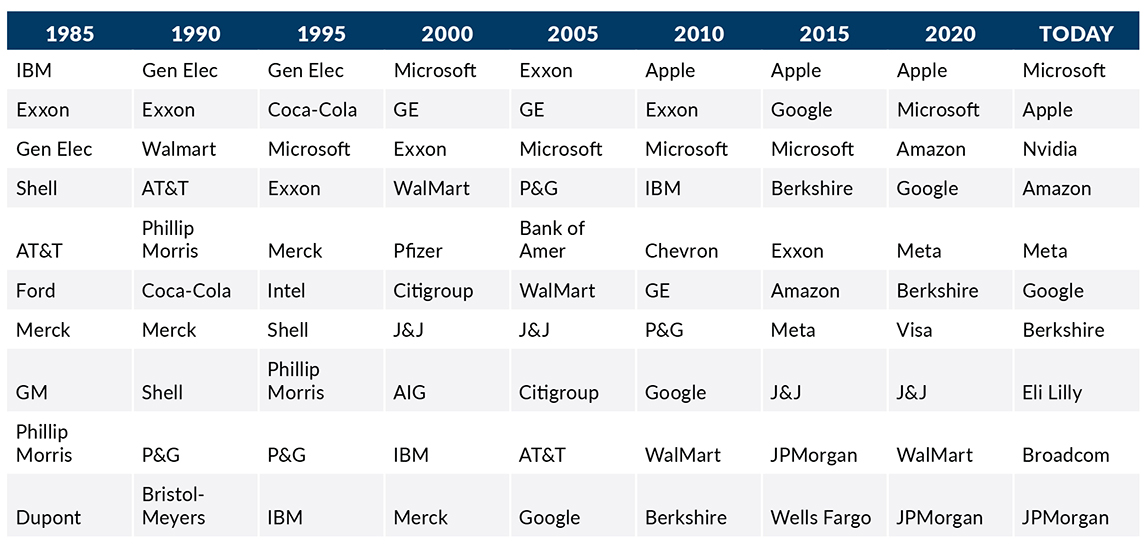

How do I know? Just look at the rotation of the S&P 500’s 10 largest companies over the past 40 years. Enormous corporations like Apple, Microsoft, Meta, Nvida, Tesla and Amazon today seem like unstoppable allocations that will dominate the S&P 500 forever – but history tells a different story.

Take a look at the 10 largest S&P 500 stock holdings over my investment career so far:

If you’re so inclined, this YouTube linkundefined also will provide a rolling visual of the S&P 500 market cap back to 1980.

Thank you for your trust in Bell Bank Wealth Management.

Greg Sweeney, CFA®

SVP/Chief Investment & Economic Strategist

Products and services offered through Bell Bank Wealth Management are: Not FDIC Insured | No Bank Guarantee | May Lose Value | Not a Deposit | Not Insured by Any Federal Government Agency