Economic Outlook July 2025

7/16/2025 1:00:00 PM

When I am in a hole that I want to get out of, I have found that the best first step is to quit digging. Of course, few of us find ourselves in physical holes; I’m speaking metaphorically, and specifically in regard to the U.S. debt situation.

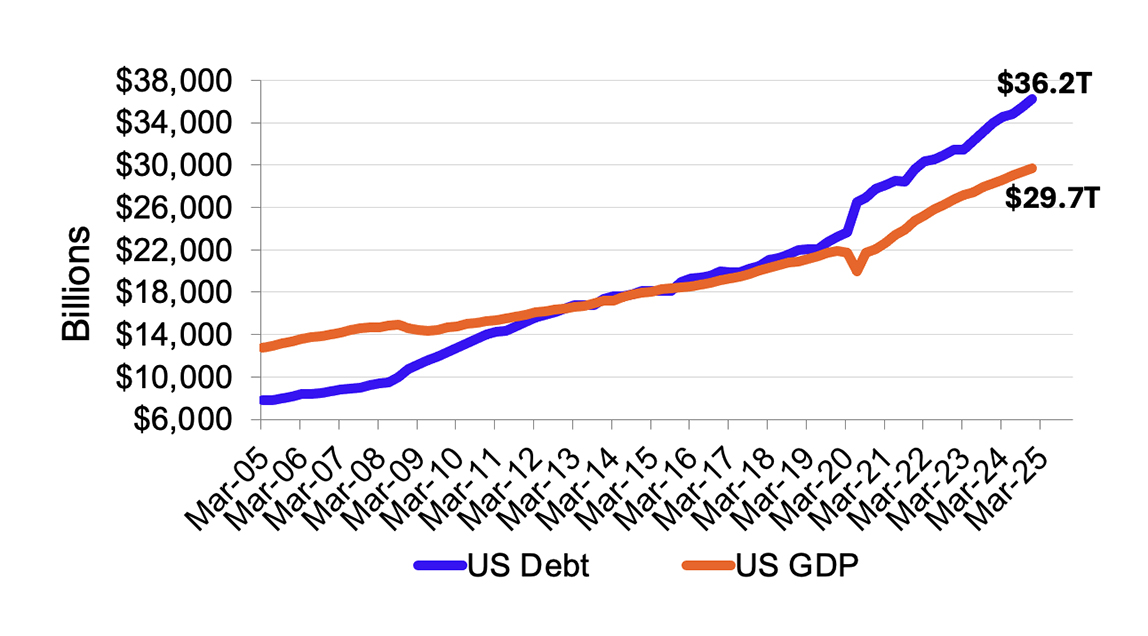

By my observation at the end of 2024, total U.S. debt was $36.2 trillion and the U.S. gross domestic product (GDP) was $29.7 trillion. This makes the debt-to-GDP ratio 122%. There are three developed countries with ratios higher than this: Italy at 135%, Greece at 162%, and Japan at 255%, according to the World Population Review.

There are many who wonder: how much debt is too much? While I don’t know the answer to that question, we could look at how we arrived at this point. In the simplest terms, society wants increasing benefits from government but finds paying for them to be quite burdensome.

According to the Tax Foundation for the year 2022 (the latest available data from that source), the top 1% of filed tax returns paid 40% of income taxes while the top 10% of tax returns paid 72% of income taxes. Politicians elected by a simple majority are sent to office to do a delicate dance between providing society as much as possible in the way of benefits while recognizing there is only a small portion of taxpayers to cover the costs. For many years, the cost of benefits has exceeded the taxes collected, resulting in an annual deficit. Each year, the deficit is added to the total debt, which, as I mentioned, stood at $36.2 trillion as of the end of 2024.

Enter Elon Musk. By his thinking, the gap between the cost of benefits and the ability to pay for them could be addressed by finding and eliminating government waste and doing things more efficiently rather than having annual deficits and rising debt. I am not able to think of anyone I know who doesn’t like to save money, but in the politics of government, there appears to be strong pushback to the concept of saving money and increased efficiency.

So here we are today. We find ourselves in a debt hole but are not able to muster the will or ability to quit digging. What does this mean for investment markets? The market concern is that deficits and debt will grow to the point where investors are not willing or able to buy all the U.S. Treasury bonds that finance U.S. debt. When this happens, investors will need more incentive to direct money to invest in U.S. Treasuries, which normally means paying higher interest rates to attract those investors. Higher interest rates on U.S. Treasury bonds flow through to higher interest rates on every other type of debt, from car loans to credit cards to home loans and corporate bonds. Higher interest rates on U.S. Treasury bonds, which are considered to be “risk free” (because the U.S. government is assumed to never default), also puts pressure on the stock market. As higher interest rates entice investors to put money in Treasury bonds, there is less money available for the stock market (or real estate, or crypto, or private credit/equity, etc.).

None of this happens in real time. There is a long and variable link among interest rates, investment markets, tariffs, inflation, etc. Predicting the timing and magnitude of the market impact is more like guessing. However, there is a recent exception to this long and variable lag concept that has come to be known as a “Liz Truss” moment. This term emerged after Liz Truss’ brief 49-day tenure in 2022 as U.K. prime minister, where her economic policies caused a market meltdown, and describes scenarios where markets react negatively to the perceived instability of economic policies.

A related concept is the idea of a “bond vigilante.” This is where bond investors quit buying U.S. Treasury bonds to send a message to politicians that the market has had enough and it is time to make tough decisions regarding debt and deficits. Rising U.S. government debt and deficits have been a concern for quite some time. It has been getting more attention recently because its trajectory increased in the wake of the great financial crisis in 2009 and then again in the wake of the pandemic.

As we navigate the markets, this is one of the current events that help to shape longer-term investment performance and is part of our consideration as we manage client portfolios.

Thank you for your confidence in Bell!

Greg Sweeney is the Chief Investment and Economic Strategist at Bell Institutional Investment Management. He guides the investment strategy, and this outlook is his perspective on the latest market trends and what they could mean for investors. Any views, strategies or products discussed in this article may not be appropriate or suitable for all individuals and are subject to risks.

Greg Sweeney, CFA®

SVP/Chief Investment & Economic Strategist

Products and services offered through Bell Bank Wealth Management are: Not FDIC Insured | No Bank Guarantee | May Lose Value | Not a Deposit | Not Insured by Any Federal Government Agency