Economic Outlook June 2023

6/2/2023 1:00:00 PM

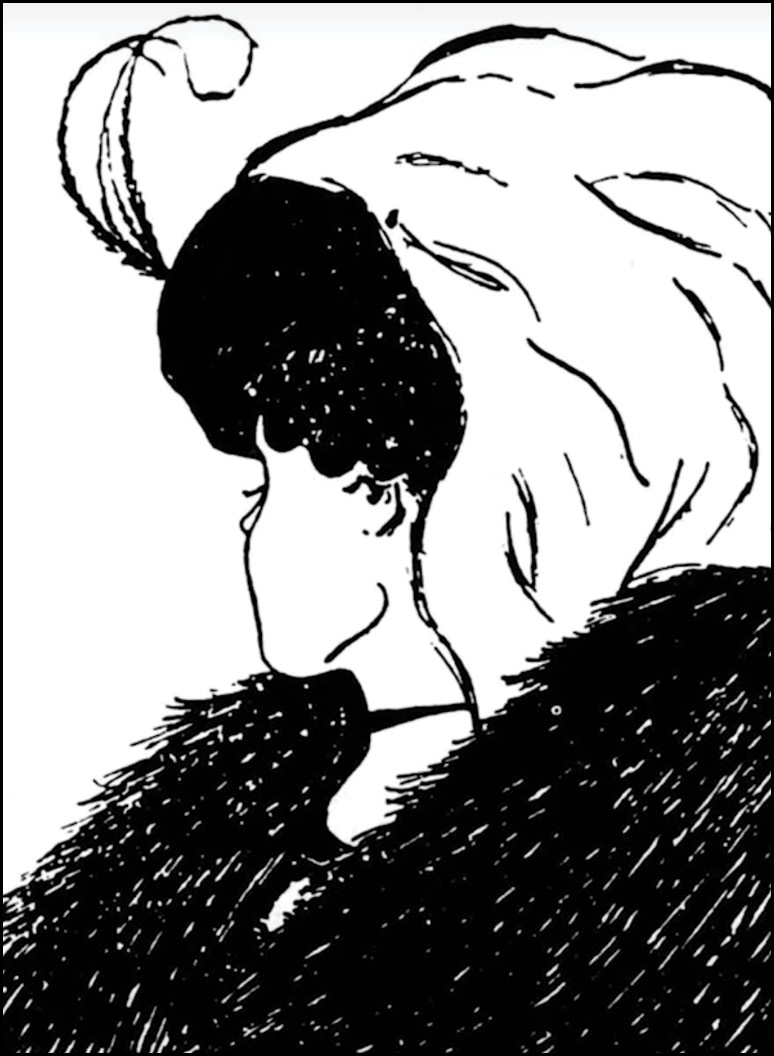

Are you able to see both an old woman and a young woman in this drawing?

It’s a classic old optical illusion, and there’s science behind how it works. Ambiguous or reversible images like this one create illusion by using similarities between distinct image forms. These induce the phenomenon of “multistable perception.”

In last month’s message, I mentioned that just a handful of companies are responsible for nearly all of the returns in popular stock indexes year to date.

This same type of illusion, seemingly caused by distinct yet similar information, spills over into economic data. Currently, some articles highlight consumers’ excess savings – while others explain that most Americans couldn’t cover a $1,000 financial emergency, and 40% are not able to cover a $400 expense. Here are excerpts from articles on each topic:

- US News report … US Households Have $500 Billion in Excess Savings, San Francisco Fed Saysundefined

- Will Daniel in Fortune …‘Turbulence ahead’: Nearly 4 in 10 Americans lack enough money to cover a $400 emergency expense, Fed survey shows undefined

- Ivana Pino in Fortune … 57% of Americans can’t afford a $1,000 emergency expense, says new reportundefined. A look at why Americans are saving less and how you can boost your emergency fund.

It seems like this data cannot exist side by side, so we ask, which one is it? Do consumers have excess savings, or are they not able to meet an emergency expense? We don’t have enough information to answer this specific question, but we know enough to question the ongoing strength of consumers who make up about two-thirds of the economy in the United States. We also look at our own economic data sources, and we do not see information suggesting there is any “excess savings.”

The stock market lacks breadth. One of the best illustrations of this is the Russell indexes. The Russell 1000 is up 9.89% this year. This index has 1,000 companies that include the same handful of large companies referred to last month: AAPL, MSFT, AMAZ, NVDA, GOOG and META. The Russell 2000 index has 2,000 companies, none of which are the popular large firms just mentioned. This index is up 1.24% so far this year. If we put these indexes together, we have the Russell 3000. Here, the influence of the large companies is so dominant that the return of the Russell 3000 year to date is 9.38%. It is hard to believe that six companies have that type of influence over the other 2,994.

Why the long explanation? Simply put, the market is much stronger if it is broad based – which is not the case today. This is one of the reasons, among others, that investors are edgy about the stock market. As an investor, there is always a desire to move to a more comfortable allocation that is reflective of the current environment. It sounds like it should be easy to do that, but decades of research show differently. Our best course of action is to look long term.

Greg Sweeney, CFA®

SVP/Chief Investment & Economic Strategist

Products and services offered through Bell Bank Wealth Management are: Not FDIC Insured | No Bank Guarantee | May Lose Value | Not a Deposit | Not Insured by Any Federal Government Agency