Economic Outlook May 2023

5/4/2023 1:00:00 PM

The Easter Bunny was always great to us kids. Every year, it would drop by unseen and leave a solid-chocolate bunny for each of us. Who could ask for anything more? That was, until the Easter Bunny pulled a fast one. Just as in years past, we found our chocolate bunny figurine – but it was HOLLOW?!?! Imagine our shock!

Some younger readers may not have known that chocolate bunnies used to be solid. Please take my word for it when I say the solid ones were much more substantial than the hollow ones.

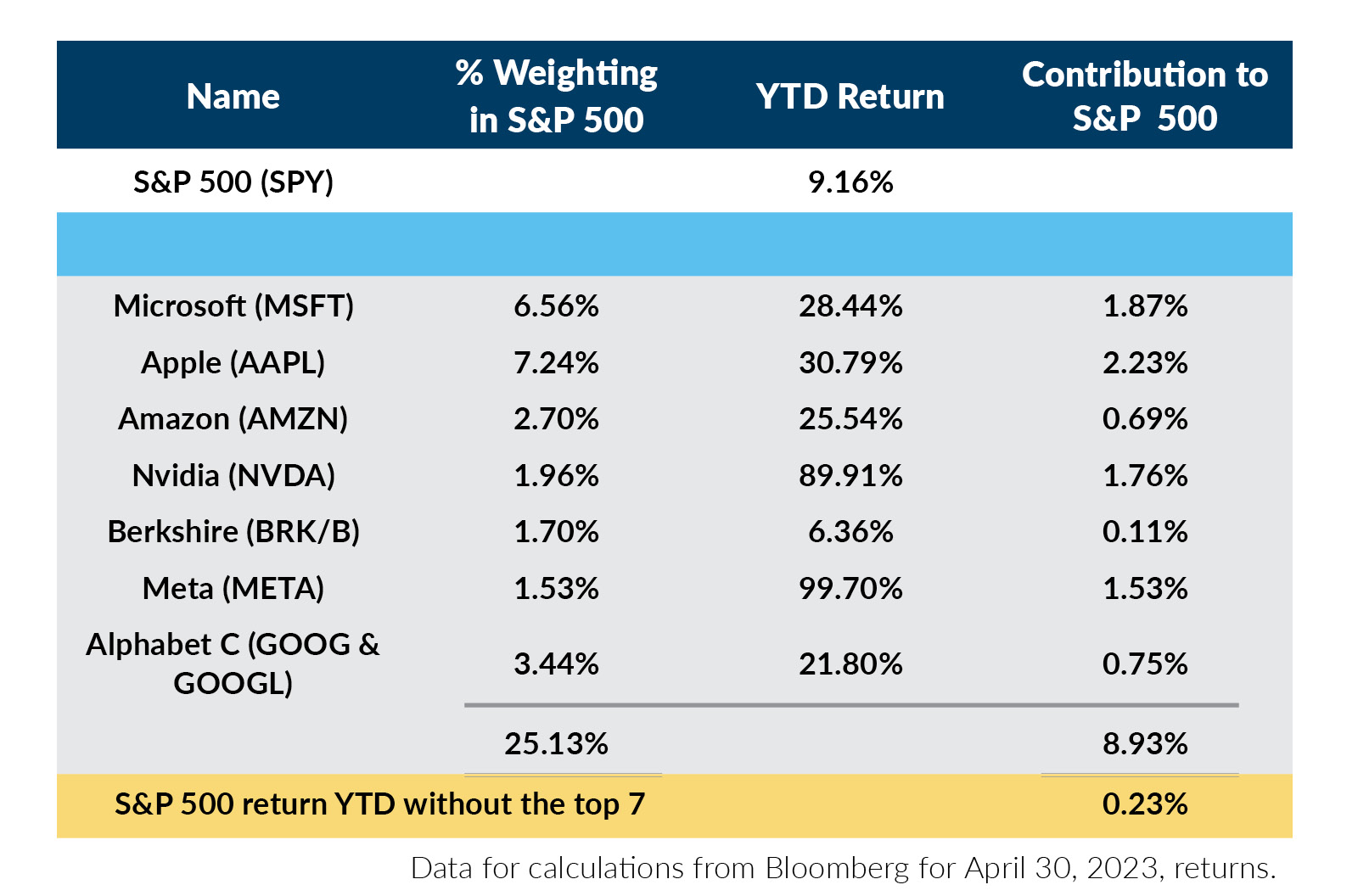

The stock market might be pulling a fast one, too. Returns through the end of April rebounded from last year’s dismal performance and are up 9.16%. However, if the largest seven names are removed from the S&P 500, the returns year to date disappear and are only up 0.23%. Right now, the stock market seems a lot like the hollow chocolate bunny. We don’t see it on the surface, but on closer inspection, the substance is lacking!

The economy grew in the first quarter, but the rate of growth was less than forecast – and not even half what it was in the fourth quarter of last year. Gross domestic product (GDP) for the first quarter was up 1.1% annualized, compared to forecasts of 1.9%. Not only did GDP come up well short of forecasts, but it was down noticeably from the 2.6% growth rate in Q4 2022. On the surface, this looks like the Fed’s plan is working by slowing the economy and moderating prices – but personal consumption expenditures (PCE), the Fed’s preferred measurement for inflation, were still up 4.6% year-over-year for the first quarter.

We believe the Fed will ultimately get inflation under control. Our concern is that the Fed is targeting 2% inflation, without appearing to consider inflation settling in at a level higher than that, perhaps closer to 3%. This concerns us not because inflation may be 3%, but because the Fed may be holding interest rates higher and longer than they should – targeting a level that may not be achievable without an overly harsh impact on the economy.

Make no mistake about it. This is a difficult economy and market for investors. The trick to moving through it is to remain focused on long-term goals while avoiding the temptation to adjust portfolio allocations for short-lived cyclical events which amount to little more than market timing.

Greg Sweeney, CFA®

SVP/Chief Investment & Economic Strategist

Products and services offered through Bell Bank Wealth Management are: Not FDIC Insured | No Bank Guarantee | May Lose Value | Not a Deposit | Not Insured by Any Federal Government Agency