Economic Outlook May 2024

5/9/2024 1:00:00 PM

When there’s an undertow, there’s a current of water below the surface moving in a different direction than the current you can see. This is how I see current economic conditions.

Financial news networks talk about how consumers keep spending, gross domestic product keeps growing, retail sales are hitting record levels and AI will propel our future.

It is interesting to note that AI has been around for a while. AI is often the first point of contact when a customer calls a business, but customers don’t like it very much. My AI-generated response to an internet search the other day was wrong by 350 miles. Other AI-generated results for historical information also came back with inaccuracies. This misinformation is detectable because it is blatantly wrong and frustrating. Sure, AI will improve – but what happens if it is just slightly wrong and harder to detect? Will AI be like my golf shot? I swing at the ball, and it initially seems on target, but it moves farther off course the farther it flies. A small error at the beginning of my hit ends up much larger by the time the ball lands. At that point, there is no correcting it.

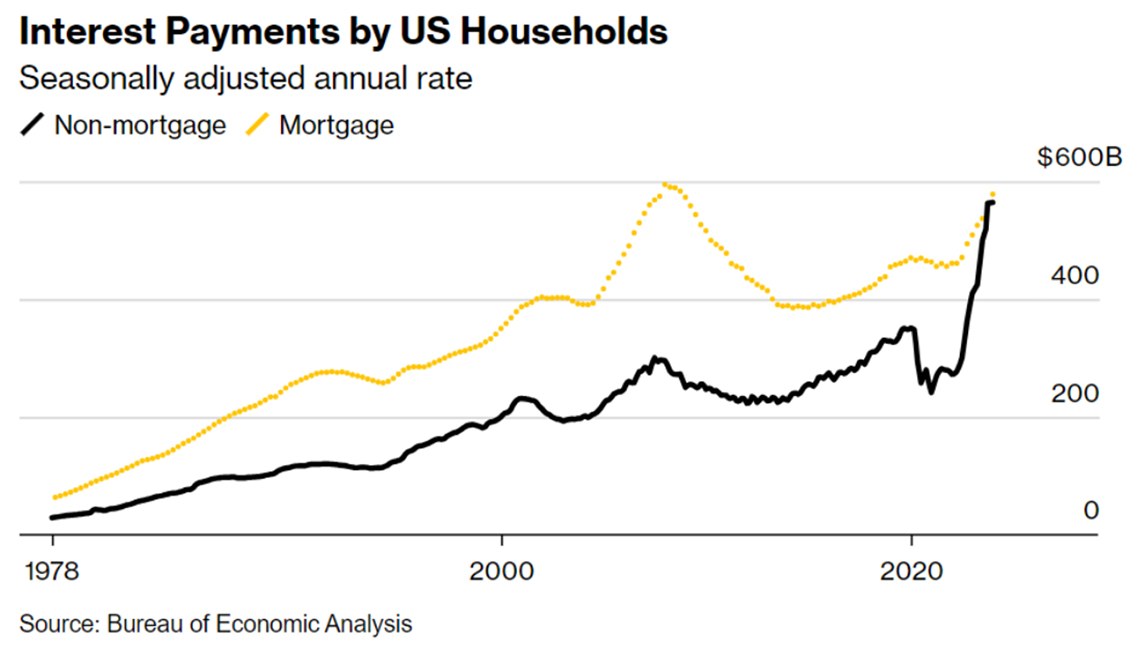

Back to the consumer world … Inflation sets all prices higher. On average, goods and services that cost $1 at the end of 2020 now cost $1.20. Inflation settling at 2 to 3% will not bring the price back down to 2020 levels. It just means it will take three years for the price to get from $1.20 to $1.30. Data I see shows marginalized consumers. To maintain spending (or keep up with inflation), consumers are decreasing savings and taking on more debt. That can only last for so long. Between more debt and higher interest rates, the monthly interest on consumer debt (excluding mortgages) is almost the same as interest paid on mortgage debt.

We also are seeing higher consumer delinquency rates on credit cards and auto loans. While it doesn’t get much headline attention, the unemployment rate is drifting higher, as 32 major companies have announced layoffs so far this year. If the consumer is slowing in the U.S., what keeps driving the economy toward growth? In my assessment, it’s large deficit spending from Congress. I believe this is also why the Fed is having a hard time with its inflation goals. Higher interest rates are slowing private consumption, but those rates have no effect on Congress’s aggressive deficit spending programs.

The stock market feels the same way. Performance from a handful of companies is driving two-thirds of the S&P 500 returns, while the “Forgotten 493” struggle to make a showing. Lack of breadth is not a good foundation for the stock market. In the early 1970s, the “Nifty Fifty” was a list of companies so appealing that their stocks should only be bought and never sold. Price did not matter – until it did. In late 1972, Xerox traded at 49 times earnings, Avon at 65 times and Polaroid at 91 times. From their highs in 1972-73 to their lows in 1974, Xerox fell 71%, Avon fell 86% and Polaroid fell 91%. Some readers probably have never heard of these companies. These were the NVIDIAs (P/E 76), Googles (P/E 25) and Amazons (P/E 51) of the day.

One moral of the story is that investors became too enamored with growth stocks in the early ’70s. Another moral is that economic growth usually doesn’t die of old age. Something happens to interrupt it. In the case of the 1973-74 recession, the disruptor was an Arab oil embargo on the U.S. in retaliation for its support for Israel in the conflict known as the Yom Kippur War (also known as the Ramadan War), when an Arab coalition launched a surprise attack on Israel. Following the start of the hostilities, the U.S. and Soviet Union resupplied their respective allies, which led to an indirect confrontation between the two nuclear superpowers at the time.

History is important. Thank you for your trust in Bell Bank Wealth Management.

Greg Sweeney, CFA®

SVP/Chief Investment & Economic Strategist

Products and services offered through Bell Bank Wealth Management are: Not FDIC Insured | No Bank Guarantee | May Lose Value | Not a Deposit | Not Insured by Any Federal Government Agency