Economic Outlook November 2024

11/6/2024 2:00:00 PM

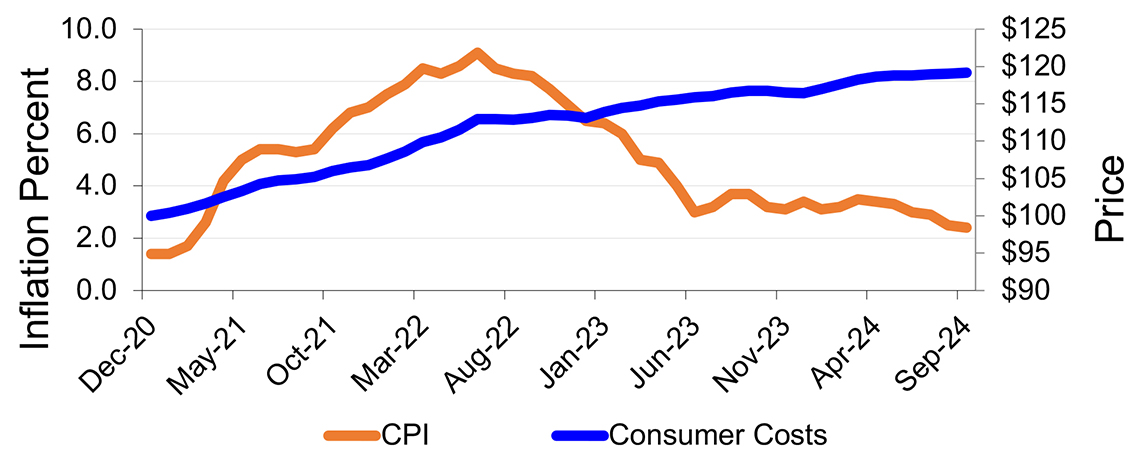

Why does it feel like inflation is still high, even though economic data suggests it’s moderating? Many consumers still consider inflation a significant drain on the family budget. There are several reasons for this. First, there’s the math behind what inflation does to prices. Our chart illustrates inflation’s cumulative effect on prices, and how it differs from the quoted inflation rates measured by the consumer price index (CPI).

Inflation’s impact on consumer prices is cumulative, becoming permanently embedded in the cost of goods and services. The righthand scale shows that a product priced at $100 at the beginning of 2021 now costs $120. On the left, the scale shows inflation peaking at 9% and down to 2.4% today. The current CPI rate of 2.4% means prices will take a year to rise another 2.4%, bringing a cost of $120 today to $122.88 a year from now. When inflation goes lower, it means future prices will rise more slowly. Prices do not decrease as inflation goes down. Deflation would have to be present to influence a decline in prices.

Another big presence putting a strain on household budgets, but not captured by CPI, is interest expense. This may come as a surprise, but higher interest costs on credit cards and car loans are not reflected in the CPI. Neither is the price of a house nor the mortgage interest or property taxes you pay on it included in CPI. This is because the CPI looks at housing as an investment and calculates a rent equivalent cost of shelter. In other words, CPI captures the cost of leasing or renting lodging that is equivalent to the house you purchased – but not the price of the house itself or the financing and tax costs associated with it.

October was a tough month for bonds, as interest rates moved higher (rising interest rates erode the market value of bonds). Fortunately, our duration exposure was more limited, protecting some of that value compared to the broader market. The market seems to be telling us the Fed may have acted too soon with its 50-basis point cut, and that inflation could remain above the Fed’s target rate of 2%. Such a scenario would be consistent with our outlook.

The higher bond yields rise, the more attractive they become as an alternative to investing in stocks. So far, market participants remain interested in the stock market even as valuations remain elevated against many metrics. The point where bonds become more attractive to stock is thought to be around a 4.5% yield on the 10-year Treasury note. Currently the 10-year Treasury note yield is 4.28%, up from 3.61% in mid-September.

Successful long-term investing isn’t about trying to guess what tomorrow will bring or attempting to concentrate on the latest trend. It’s about setting an allocation consistent with your personal investment profile and taking a long-term approach to the ultimate goal.

Thank you for allowing us to work with you toward those goals.

Greg Sweeney, CFA®

SVP/Chief Investment & Economic Strategist

Products and services offered through Bell Bank Wealth Management are: Not FDIC Insured | No Bank Guarantee | May Lose Value | Not a Deposit | Not Insured by Any Federal Government Agency