With Recent Interest Rate Cuts, Things Are Looking Up for CRE

12/23/2024 2:00:00 PM

2024 could be defined as a year of anticipation for commercial real estate (CRE) investors, developers, banks, and other related sectors. These groups had been patiently waiting for the Federal Reserve to cut interest rates so CRE investments, developments and lending could become more attractive – and now that three rate cuts have happened, positive developments are on the horizon for the CRE industry. Here’s what to know about how we got here and where we may be headed in 2025.

The Impact of High Interest Rates on the CRE Industry

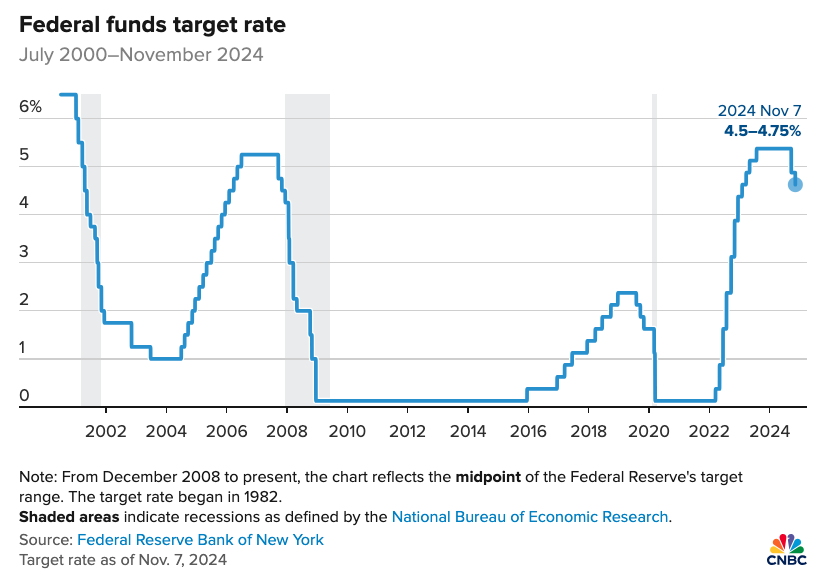

In 2020, the Fed cut the federal funds rate, a short-term borrowing rate, to 0% to help boost the economy through the COVID-19 pandemic. At the same time, government stimulus packages injected a surplus of cash into the economy, which resulted in increased consumer spending. Higher spending led to higher inflation, which stayed elevated while the job market remained strong. To combat inflation, the Fed raised the fed funds rate at record speeds to a range of 5.25%-5.50%, a 23-year high.

Those rapid rate hikes had a domino effect on the CRE industry: higher rates increased banks’ cost of funds, which led to higher pricing as lenders increased the interest rates charged on CRE loans. Higher pricing raised required loan payments, and loan sizes were constrained by a project’s debt service coverage ratio, which required borrowers to bring more equity into new deals. Additionally, some existing loan portfolios began to experience stress as loan payments increased on variable- or resetting fixed-rate loans. All of these dynamics resulted in reduced returns for CRE investors and led to steep declines in new construction and real estate sales throughout 2023 and 2024.

After several years of high rates, the Fed finally cut rates in September, and then again in November and December, resulting in a one percentage point drop in the fed funds rate during 2024. The December cut brought the target range down to 4.25%-4.5%, essentially where the fed funds rate was in December 2022 when rates were on their way up.

Looking ahead, Fed Chair Jerome Powell indicated after the December 2024 FOMC meeting that there will be fewer rate cuts in 2025 than previously anticipated given that inflation still remains above the Fed’s target level. Based on the FOMC’s quarterly reporting as of December, Federal Reserve Board members project a median fed funds rate of 3.9% for 2025. Even though that’s up from the median projection of 3.4% from September 2024, we should continue to see reduced borrowing costs by the end of 2025 if those projections hold.

What This Means for CRE Lending

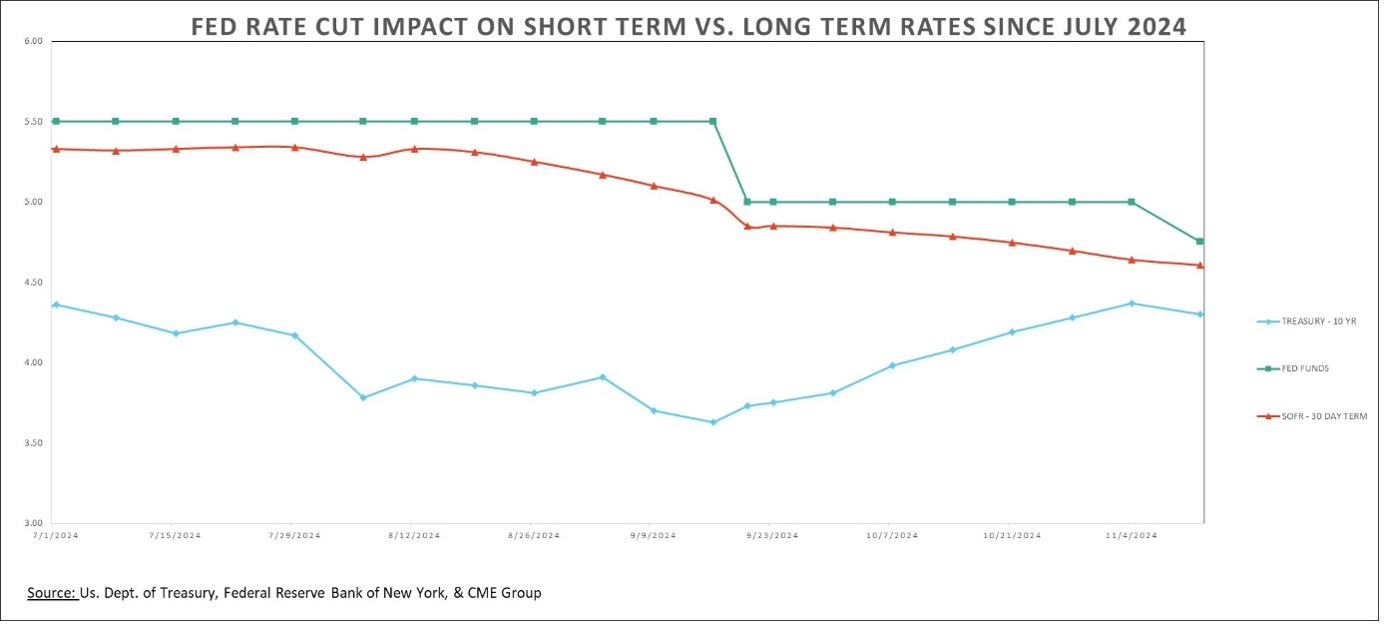

The recent rate cuts – and projections of further cuts – are good news for the CRE industry. Because the fed funds rate is a short-term borrowing rate, the rate cut will have the largest impact on short-term CRE loans, including construction, bridge and mini-perm loans. These variable-rate loans are typically priced based on the Secured Overnight Financing Rate (SOFR) index. 30-Day Term SOFR has dropped from its peak of 5.33% in mid-August 2024 to 4.36% following the December 2024 FOMC meeting.2

Moreover, the rate cuts signal to sidelined investors that now is the time to start deploying capital, which should lead to increased construction starts and real estate sales. Lower interest rates will also improve property cash flow and returns on CRE investments. It’s important to note, however, that these initial cuts will take time to reverse the impacts of the steep rise in rates that occurred over the last couple of years, and it will take more rate cuts to meaningfully impact long-term CRE debt holders and consumers.

Further, there remains concern that inflation will remain above the Fed’s 2% core inflation target, which could result in interest rates staying higher for longer. Additionally, there is uncertainty around how President-elect Donald Trump’s fiscal policies will impact the economy and inflation. How the Fed handles additional rate cuts in 2025 will continue to provide a pulse on the current state of the U.S. economy and the CRE sector.

1 Transcript of Chair Powell’s Press Conference September 18, 2024undefined

2 Data from the CME Group

Ann Olson

SVP Commercial Real Estate Banker