Industry Expertise

Capital Finance

A division of Bell Bank that specializes in providing senior cash flow loans to lower middle market businesses.

Your Sponsor Finance Partner

Bell Capital Finance partners with companies:

- Across all industries

- With revenue ranging from $10-100 million

- That have EBITDA ranging from $3-10 million

Our transactions support the acquisition activity of private equity groups. We also provide senior cash flow loans in connection with non-sponsored transactions, including:

- Acquisitions

- Leveraged buyouts

- Refinancing

- Growth capital

- Management buyouts

- Generational or succession related transactions

- Recapitalizations

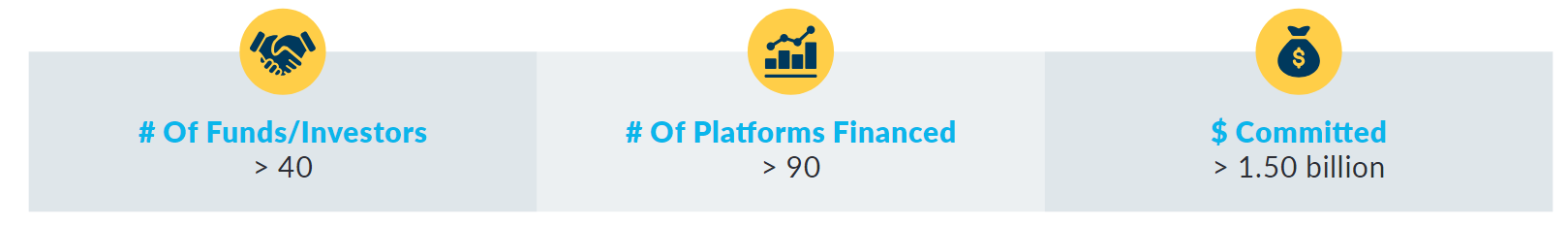

Since 2014 Bell Capital Finance has demonstrated its commitment, reliability and speed to lower middle-market investors with highlights including:

Get in Touch

To learn more about how Bell Capital Finance can help your business, connect with our team at 952-905-5032, bellcapitalfinance@bell.bank, or by filling out the form below.