Positive Signs for Manufacturing Industry Despite Ongoing Challenges

8/12/2024 1:00:00 PM

The past year was a challenging one for manufacturers. Continued high interest rates and a gradual economic slowdown led to declines in manufacturing business. However, there are signs that these contractionary patterns could reverse in the coming quarters. Easing inflation, a softening labor market, and interest rate cuts could all provide needed relief to the industry and eventually usher in a new period of expansion.

More than halfway through 2024, here’s a look at the current state of the manufacturing industry, and what business leaders can do if and when conditions change.

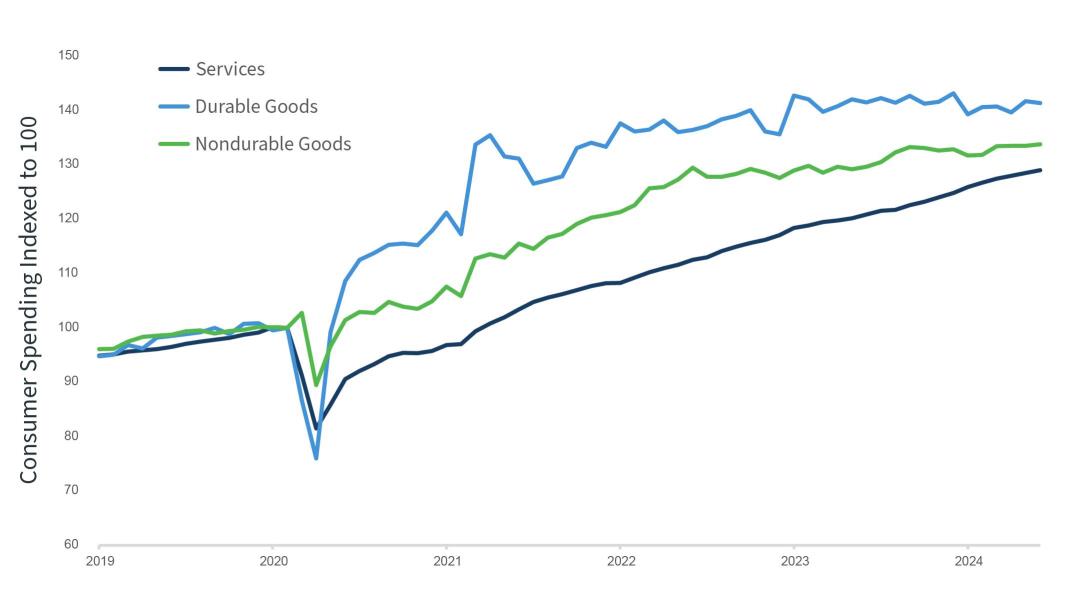

Goods consumption is normalizing while services consumption remains strong

Manufacturing Faces Headwinds

It’s been over a year since the Fed last raised rates in July 2023. The fed funds rate, a key determinant of short-term interest rates, has now held steady at 5.25 as the Fed waits for more evidence that inflation is returning sustainably to its 2% benchmark. These high interest rates have gradually slowed the economy without pushing it into recession, but this slowdown has not occurred evenly across sectors. After manufacturing initially rebounded strongly from the pandemic recession, it has struggled to keep pace over the past year.

High interest rates have weighed especially heavily on manufacturing by suppressing demand for larger investments and new projects, as well as consumer spending on durable goods. As the chart above shows, spending on durable goods was particularly distorted by the pandemic. The combination of interest rates dropping to near zero and Americans having limited options to spend their money created a sharp rebound from the pandemic lows. However, this spending has since slowed and has been flat or even declining over the past year as interest rates have remained high.

High and volatile interest rates have also made it challenging for manufacturers to invest in their businesses. These effects are magnified in manufacturing due to the industry’s capital intensity. Between hot inflation over the past three years and high interest rates, buying new equipment or supplies is significantly more expensive for manufacturing businesses.

Hiring and retaining employees has also proven challenging for manufacturers in the midst of a historically competitive job market. Furthermore, manufacturing employees often require significant training and investment, making it expensive and difficult for manufacturers to fill open positions or expand their teams.

These hiring challenges have been pronounced in the Midwest. While the national unemployment rate is just over 4%, it is lower in many midwestern states. Minnesota’s unemployment rate is just 2.8%, both North and South Dakota’s are 2%, and Wisconsin’s is 2.9%. In the Midwest, there are 1.3 job openings for every unemployed person, just below the national level of 1.2.

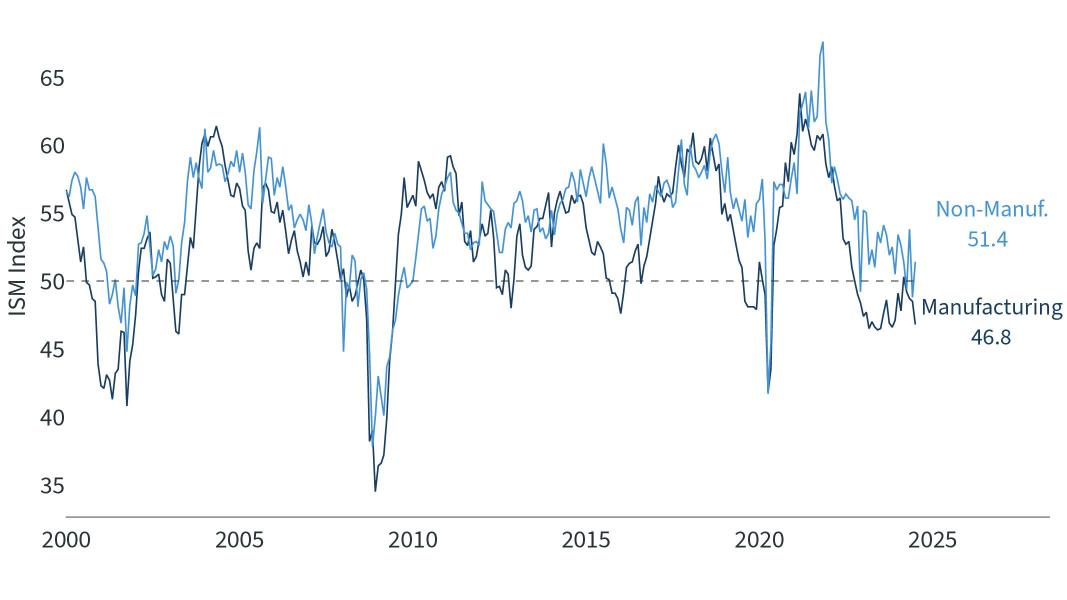

The manufacturing industry is still slowing, but less so than last year

Positive Signs on the Horizon?

Despite these challenges, there have been some positive signs for the industry this year. New legislation, including the American Rescue Plan, Bipartisan Infrastructure Law, CHIPS and Science Act, and the Inflation Reduction Act, have continued to increase investment in domestic manufacturing. Although these examples have not accelerated activity as much as some had hoped, they have still had a positive impact across industries by supporting reliable infrastructure as well as investing in new technology.

Moreover, the economy in general remains healthy and should continue to stabilize throughout the rest of 2024, which could mean more predictable levels of demand for goods and services, stable interest rates, and less competitive labor markets. These moderating conditions could provide a strong foundation for businesses to improve their operations.

How Business Leaders Can Take Advantage of Improving Conditions

Looking ahead to the second half of the year and beyond, business leaders should aim to invest in technology and efficiency when possible to ensure their organizations are prepared for a wide variety of economic scenarios. Leaders should also take advantage of state and federal programs that incentivize domestic manufacturing. The continued rollout of major federal initiatives to increase domestic manufacturing may offer significant benefits to businesses.

Additionally, it’s important to work with partners who understand your business. A close relationship with a trusted banking partner can help your organization respond to opportunities and challenges throughout different types of economic cycles. For example, if demand is stronger than anticipated, having a partner who knows your business could help accelerate the timeline for receiving critical funding to meet new orders. When challenges arise that require a strategic pivot or investment, a close partnership can help your organization overcome those hurdles.

Although manufacturing still faces significant challenges, prospects appear to be slowly improving. Taking advantage of opportunities when they present themselves can help businesses succeed across market and economic environments.

Related Content

What Business Owners Should Know About Succession Planning

In the United States, baby boomers own 51% of all small businesses, according a report by the Exit Planning Institute.

Access Full FDIC Coverage Through Bell’s Insured Cash Sweep Program

When your business has liquidity needs, you can count on Bell Bank’s Insurance Cash Sweep (ICS) through IntraFi Cash Services.