Trends That Could Impact Business Strategy in 2025

11/19/2024 2:00:00 PM

As 2024 comes to a close, a range of factors are shaping business strategies for leaders and executives. Following several difficult years of inflation, rising interest rates and uncertainty, 2025 promises to bring both new opportunities and new challenges.

While leaders might prefer to use a crystal ball in making long-term decisions, they instead have to make the most of information that’s available to them. Navigating volatile years, such as 2020 during the pandemic or 2022 when interest rates began to increase, underscored the importance of careful, strategic planning to stay competitive.

Let’s look at the various trends, dynamics and industries that could affect business strategy in the months to come, and what leaders can do to position their businesses for success.

The Fed

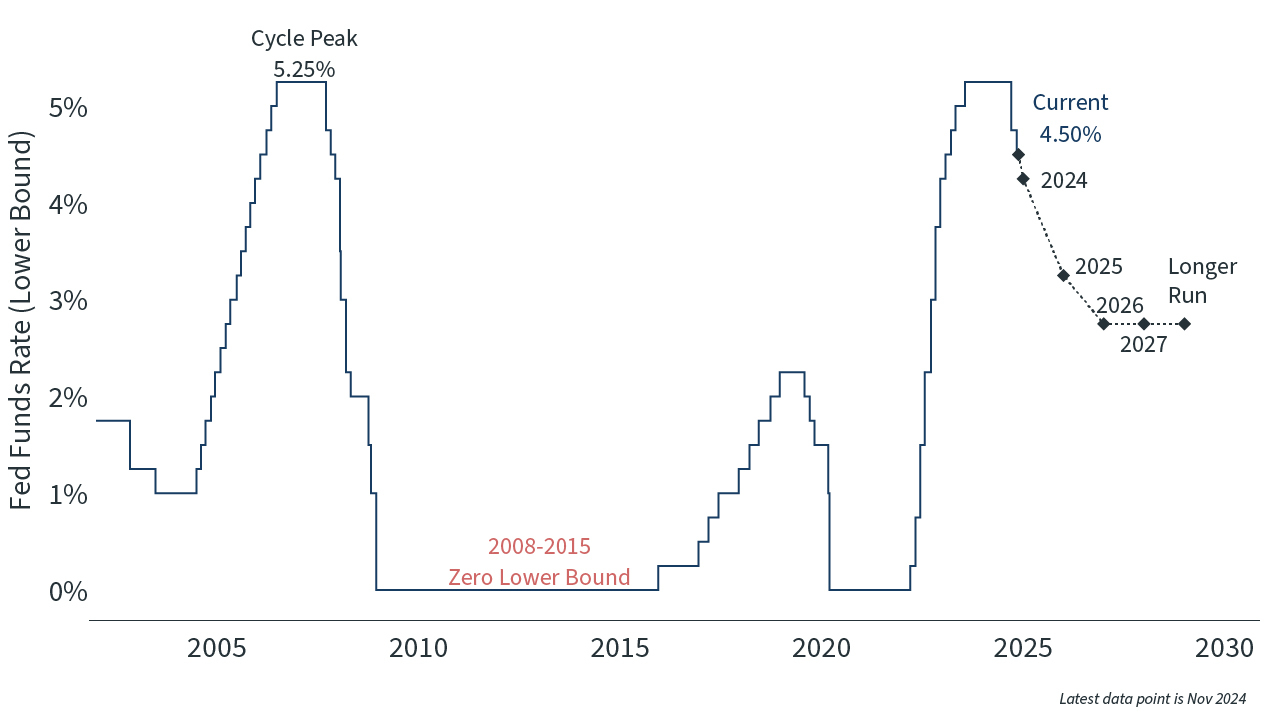

First, the Fed’s pivot toward monetary easing in September marked a significant shift in the economic environment. With inflation steadily moving toward the Fed’s 2% target and unemployment holding steady at 4.1%, the Fed recently announced a second rate cut at its November meeting, a move signaling confidence in the economy while aiming to support controlled growth.

The implications of lower interest rates extend across the economy. Reduced borrowing costs tend to stimulate business investment and consumer spending, while the housing market benefits from more affordable mortgage rates. These conditions often create a supportive environment for economic expansion, though the full effects typically emerge over time. The Fed’s continued rate cuts will be an important economic story in 2025.

The Election

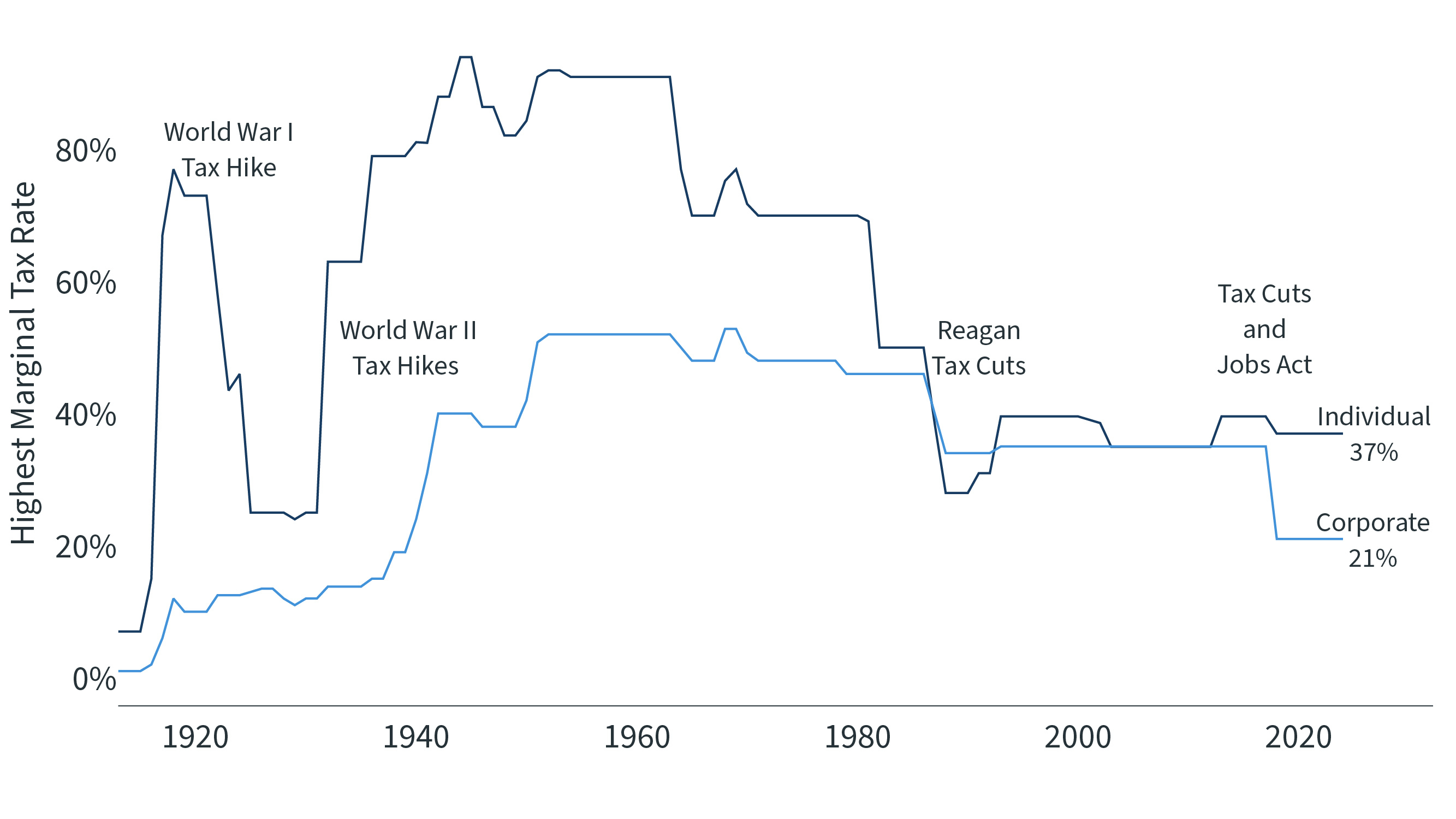

The recent U.S. presidential election also has obvious implications for 2025 and beyond. Donald Trump’s victory led to an immediate pop in markets, as investors reacted to the definitive outcome. The fact that the result was conclusive also means there is less uncertainty around which policies a Trump administration may implement. During his campaign, Trump pledged lower taxes, including a reduction to 15% for the effective corporate tax rate for domestic production, which could lead to a boost for the economy.

Trump also made nearshoring and trade a big part of his platform, proposing higher tariffs on imports – especially those from China. Some economists have pointed out that tariffs can be inflationary as they result in higher prices for consumer goods. As Trump takes office in January, the policies his administration implements could have wide-ranging impacts.

Industry Trends

Beyond economic policy and a new presidential administration, several industries stand out for their potential to help drive growth in 2025. By focusing on the changing dynamics in these sectors, business leaders could find opportunities to innovate and gain a competitive advantage.

- The green energy and sustainability sector continues to expand, driven by an increasing global focus on carbon reduction. Government incentives and private investment are accelerating the development of renewable energy infrastructure and energy-efficient technologies.

- The healthcare industry is undergoing rapid transformation, particularly through technological integration. Advanced data analytics and artificial intelligence are revolutionizing patient care, drug development and healthcare delivery systems.

- Digital commerce continues its expansion, with evolving consumer preferences driving innovation in the industry. The integration of artificial intelligence and advanced analytics enables increasingly personalized shopping experiences, while more and more businesses adopt digital payment systems and mobile commerce platforms, helping to reshape traditional retail models.

Global Economic Trends

Finally, international trade patterns are experiencing significant shifts, with many organizations prioritizing supply chain resilience and diversification. There is also a growing trend toward regionalization and nearshoring of production, as businesses seek to balance efficiency with risk management.

Emerging markets continue to play a crucial role in the global economy, with a growing middle class in developing nations driving consumption while the rapid adoption of digital technologies creates new markets and business models. The expansion of fintech solutions in these regions is particularly noteworthy, enabling greater financial inclusion and economic participation.

Additionally, sustainable development initiatives are gaining momentum around the world, with both developed and emerging economies increasing their focus on green growth. This trend will create favorable conditions for innovation and investment moving forward.

Positioning Your Business for Success

The economic environment going into 2025 presents a complex mix of opportunities and challenges, and business leaders will need to adapt strategies to navigate this landscape. The ability to anticipate and respond to changing dynamics across monetary policy, industry transformation and global economic shifts will be crucial for businesses in the months to come.

While uncertainty remains a constant factor, current economic indicators suggest a period of measured growth ahead. Organizations that maintain flexibility while pursuing strategic initiatives in emerging areas will be best positioned for long-term success.