2026 Economic Outlook: Inflation, Credit and Other Areas to Watch

1/7/2026 2:00:00 PM

In the first part of our 2026 Economic Outlook, we looked at the artificial intelligence (AI) investor frenzy, and how we can perhaps learn from past trends as we look ahead to where things might go from here.

In this article, we will discuss the other areas of note that could have an outsized impact on the economy and the markets in the year ahead. Here are the key themes and topics we are watching, and what they could mean for you.

Cost of Living and Inflation

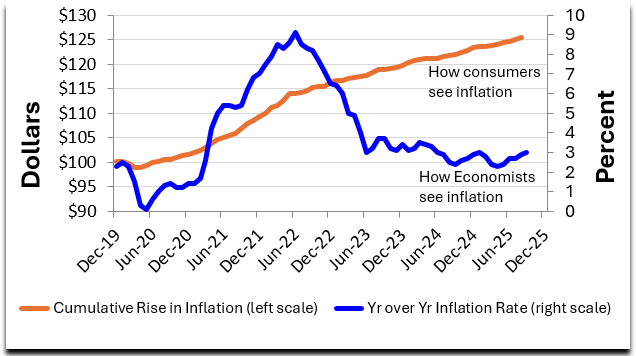

Consumers have experienced elevated inflation over the last five years, and a common question is whether 2026 will offer any relief. Our December monthly outlook provided a detailed perspective about how inflation affects costs for consumers. In short, inflation price changes are cumulative and continue to rise in spite of official commentary to the contrary. This puts pressure on consumers, as income has not kept pace with the cumulative effects of inflation. A picture is worth a thousand words:

When we hear news reports about the consumer being “strong” and continuing to drive retail sales, our interpretation is the top 10% of consumers are indeed “strong” while the remaining 90% are struggling to keep pace with everyday living costs. Our thinking on this is supported by a range of data points, including delinquency rates on debt, unemployment trends, confidence reports and escalation in “buy-now-pay-later” options.

The Federal Reserve is in a tight spot. It has two mandates: maximum employment and stable prices. New job creation has been slowing, so there are calls for the Fed to reduce short-term interest rates to support increased hiring. This would support the maximum employment mandate. The risk, however, is that cheaper money (lower short-term interest rates) could put upward pressure on inflation and further increase prices for consumers.

The Fed likes to say it is “data dependent,” which means it will use data to determine where to set interest rates. In the past, it was normal for the Fed to be “rule dependent.” This meant the Fed would look to the Taylor Rule as a means of setting short-term interest rates. In simple terms, the Taylor Rule suggests that central banks should raise interest rates when inflation is above target levels or the economy is operating beyond its potential, and lower interest rates when inflation is below target levels or the economy is operating below its potential.

That seems simple enough in theory, but when the two mandates are in competition with each other, establishing a path forward gets much more complicated. We expect to see Fed reluctance to cut short-term rates aggressively in 2026 unless inflation is headed lower.

Credit Concerns?

Another area we’re watching is credit, particularly what’s known as “shadow banking.” Shadow banking is a network of lending intermediaries that provides credit to borrowers but operate outside of regulatory boundaries. These non-bank finance companies create credit without the same regulatory guidelines required of banks.

The common term for this industry today is called “private credit.” Investors in private credit are “qualified” investors, which means they must meet regulatorily defined financial thresholds that serve as a proxy for sufficient knowledge to understand the risks they are exposed to as they pursue the higher income potential from this form of lending. The expansion of and competition for this private credit industry lowered the cost of borrowing for companies using these non-bank lending channels. This increased competition in private credit also has compressed the incremental return available to investors.

Today, there are reports of rising stress levels percolating in private credit. Companies like United Site Services, Tricolor and First Brands Group are defaulting on loans. Critics argue this exposure comes from lax lending standards or compromised assets used as collateral for loans. There also are differences in opinion when establishing the underlying market value for loans in a private credit facility.

There has been a big push to make private credit available to retail investors, including 401(k) plans. Our cynical side feels that the source of funds from qualified investors has slowed down and the industry is looking for other avenues to keep investment dollars coming in. We also feel that past returns in the private credit space will not be indicative of future returns.

In short, we see credit spreads at decade lows. This means that everything from high-grade, publicly traded corporate credit to junk bonds is no longer compensating investors for risk as they have in the past. Looking forward, we see the potential for some sort of credit event. The last time this happened in 2008-2009, the borrowers were homebuyers. This time it could be corporate borrowers.

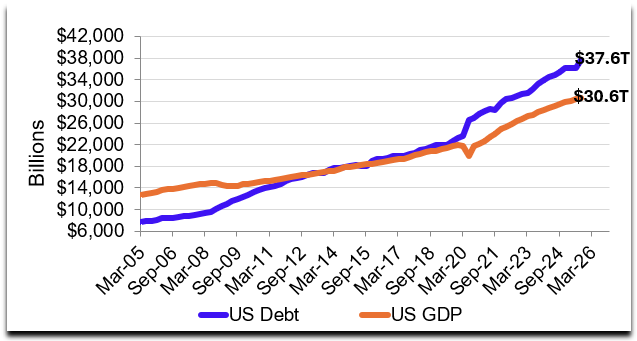

Speaking of credit, U.S. debt levels as a percentage of gross domestic product remain at the very high end of the historical range. The only time it was higher was right after the pandemic. As of the time of this writing in late 2025, debt was 122% of GDP. Interest payments on this debt are over $1 trillion per year and there does not appear to be any political will to address it. Where it stops and how it stops will remain a mystery for now.

Reasons for Optimism

After several dour points, you may be asking: Is there any sunshine forecast for 2026? Absolutely. Tariffs, like them or not, have had the effect of encouraging foreign providers to take a stronger presence in the U.S. There have been numerous announcements from firms outside the U.S. implementing capital spending programs and building facilities here. That is likely to provide a notable segment of economic growth for years to come. This will tend to support skilled labor for construction and implementation, along with operational staffing for facilities moving forward. Other predictions for 2026 include:

Additionally, the 2025 tax bill included provisions for existing U.S. companies to support expansion with faster depreciation schedules of capital expenditures, encouraging more economic growth and job prospects.

To the extent that AI continues to expand, power generation and delivery will remain in growth mode for years to come. Demand for power will include alternative energy, but the alternative space will not be capable of reliably supplying the necessary levels, leading to an expansion of traditional sources of generation capacity. This will translate to growth in power distribution networks, including powerline capacity.

Other predictions for 2026 include:

- China is working its way forward and will likely be a larger part of the world’s growth engine than it has over the last couple of years.

- If black swan events remain absent from the horizon, we see 2026 economic growth around 2.25%, supported by capital investment, skilled labor demand, rising disposable income and supportive monetary policy.

- The outlook for the stock market, meanwhile, is for moderating returns in the direction of longer-term market averages in the 9% range. Continued speculation in the AI race could push that return estimate higher while some attrition could move it lower.

- The bond market may see some defaults from marginal corporate borrowers, but we do not expect to see this for investment-grade bonds. While short-term rates may be headed lower, we see longer-term rates remaining stable, perhaps even with an upward bias. We anticipate bond returns in the range of 4% to 5%.

- Returns on money market investments will be largely determined by short-term interest rates. Given the current trajectory, that is probably in the range of 3.25%.

Other Areas to Watch

Gold and silver were standout performers in 2025. It is hard to speculate on what drives interest in this space. Gold and silver are industrial metals, a store of value, an inflation hedge and a currency hedge. At any given time, one or more of these themes can push the price up or down. The direction for 2026 is anyone’s guess. Finally, cryptocurrency has seen quite a bit of volatility lately. The blockchain that supports cryptocurrency is a collective group of high-end computers housed in a location with excellent power sources. These are not too different from the computer systems used by AI. We wonder if part of the cryptocurrency sell-off in late 2025 is related to the owners of these systems pulling them from the blockchain and leasing them to AI instead.

Thank You for Your Business!

These predictions may come to pass, or, perhaps more likely, 2026 will go in directions we have not anticipated. Whatever happens, Bell Bank Wealth Management will remain focused on the long term to help you meet your investment objectives. Thank you for being a Bell Bank Wealth Management client and for your confidence in us. Best wishes for a great 2026!

Greg Sweeney is the Chief Investment and Economic Strategist at Bell Institutional Investment Management. He guides the investment strategy, and this outlook is his perspective on the latest market trends and what they could mean for investors. Any views, strategies or products discussed in this article may not be appropriate or suitable for all individuals and are subject to risks.

Greg Sweeney, CFA®

SVP/Chief Investment & Economic Strategist

Products and services offered through Bell Bank Wealth Management are: Not FDIC Insured | No Bank Guarantee | May Lose Value | Not a Deposit | Not Insured by Any Federal Government Agency