Tips to Save for Retirement

12/21/2023 2:00:00 PM

No matter where you are in your life or career, the idea of saving enough money for retirement can seem intimidating – but it doesn’t have to be. With a few simple steps, you can be well on your way to a healthy portfolio and a long, happy retirement. Here’s how you can take action today to prepare for a successful tomorrow.

Start saving as early as possible

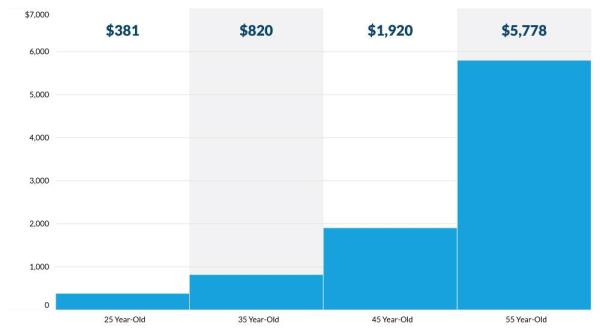

When it comes to saving for retirement, waiting just a few years to begin can have a major impact on what you’re able to put away. For example, if your savings goal is to have $1 million by the time you’re 65, but you don’t start saving seriously until age 45, you would need to set aside $1,920 per month (assuming a 7% rate of return). If you had that same goal and started saving at age 25, you would only need to set aside $381 per month.

That example demonstrates how your savings can grow over time, and how one of the best and easiest things you can do for your retirement is start saving today. You will thank yourself later.

This is for illustrative purposes only and not indicative of any investment. © Morningstar 2023 and Precision Information, dba Financial Fitness Group 2023. All Rights Reserved. About the data: The image represents monthly savings necessary using a 7% hypothetical rate of return (compounded).

Set up a budget

During our working years, retirement planning is all about saving as much as we can for as long as we can. Depending on your personal style, it could be useful to set up a budget to determine where your hard-earned money is going and whether you need to make any adjustments to your spending.

Making minor tweaks to your day-to-day spending, like cutting back on subscriptions or bringing your lunch from home rather than dining out, could help you save more on a regular basis.

Take advantage of your employer match (if you’re able)

If your employer offers a match on your workplace retirement plan, you should contribute enough to take advantage of the benefit. For example, if your employer offers a 3% match, all you need to do is contribute 3% of your income to your plan to lock in an immediate 3% contribution from your employer. By not taking advantage of that opportunity, you’d essentially be leaving free money on the table.

All retirement plans are different, so be sure to refer to your plan documents for your specific employer matching and vesting policy.

Set it and forget it

Saving for retirement is a long-distance marathon, not a sprint, and so it’s important to stay the course and stick to your plan even in times of market volatility. That means regularly contributing to your retirement, whether through a workplace retirement plan like a 401(k), an individual retirement account (IRA), or both; selecting prudent investments; and letting time do the rest. Workplace retirement plans make this easy by letting you defer a percentage of each paycheck directly into your retirement account, helping you put your savings on autopilot.

Make the most of your 401(k) tax benefits

In addition to helping you save for tomorrow, your 401(k) could also help lower your tax bill today when you make pre-tax contributions. That means you’re deferring income from your paycheck directly into your 401(k) before taxes are deducted. Depending on your personal situation, lowering your overall taxable income could put you in a lower tax bracket and impact what you owe come tax time. You’ll have to pay taxes on those funds eventually, but not until retirement.

Alternatively, if your employer offers a Roth 401(k) option, or you have a separate Roth IRA, you’re able to contribute funds after-tax. That money would then grow tax-free, and you’d pay no additional taxes on your retirement withdrawals.

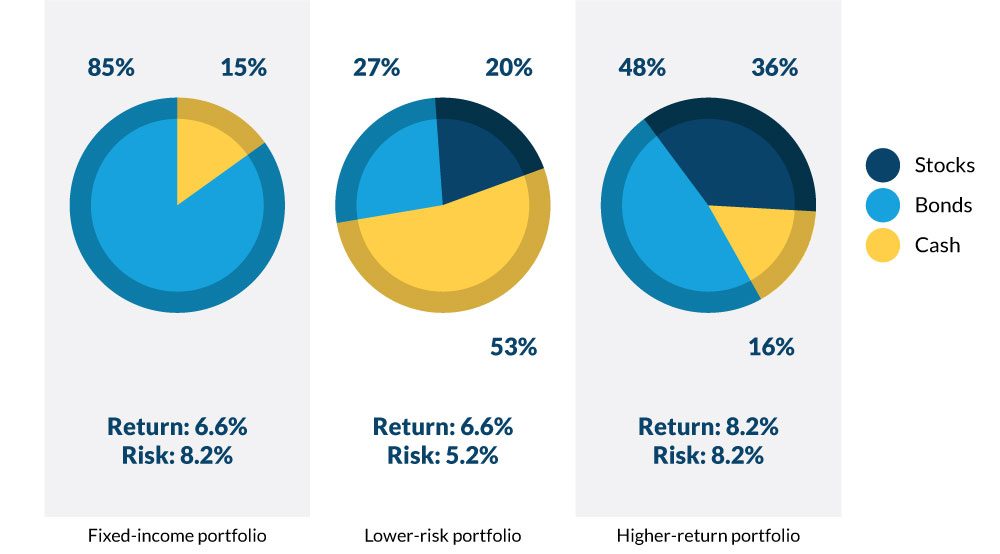

Diversify

It’s no secret that markets can fluctuate up and down, often in the same day. That’s why it’s important to diversify your portfolio by investing in different types of assets, such as stocks, bonds, mutual funds and more. This helps maximize your portfolio’s returns over the long term, while minimizing your exposure to risk during short-term market volatility. In other words, diversification helps you protect yourself by not putting all of your retirement eggs in one investment basket.

If you’re not sure how to diversify your portfolio, automated target date funds make it easy. These funds, which are available in both workplace retirement plans and IRAs, target a specific retirement year, and are rebalanced from an aggressive mix in the early years to more conservative assets over time as the selected date approaches.

Past performance is no guarantee of future results. Risk and return are measured by standard deviation and compound annual return, respectively. They are based on annual data over the period 1970–2022. This is for illustrative purposes only and not indicative of any investment. An investment cannot be made directly in an index. ©Morningstar 2023 and Precision Information, dba Financial Fitness Group 2023. All Rights Reserved. About the data: Stocks are represented by the Ibbotson® Large Company Stock Index. Long-term government bonds are represented by the 20-year U.S. government bond, intermediate-term government bonds by the five-year U.S. government bond, and cash by the 30-day U.S. Treasury bill. Bonds represent an equally weighted portfolio of long-term government bonds and intermediate-term government bonds. All portfolios are rebalanced annually. Risk is measured by standard deviation. Standard deviation measures the fluctuation of returns around the arithmetic average return of the investment. The higher the standard deviation, the greater the variability (and thus risk) of the investment returns. An investment cannot be made directly in an index. The data assumes reinvestment of all income and does not account for taxes or transaction costs.

Understand where you are, and where you’re going

Although there’s no hard and fast rule about how much money you’ll need to retire, a general guideline is between 70% and 80% of your pre-retirement income per year. Of course, what you will actually need will depend on your goals for retirement. Are you planning to travel? Do you want to downsize? Will you want to work part-time to keep busy? Understanding what you’re saving for can help you measure your progress as you approach retirement.

Products and services offered through Bell Bank Wealth Management are:

Not FDIC Insured | No Bank Guarantee | May Lose Value | Not a Deposit | Not Insured by Any Federal Government Agency

Work with a Professional

Whether you’re just getting started saving for retirement or you’ve been saving for decades, you don’t have to go it alone. Bell Wealth Management can help make sure you’re on track for a secure retirement. Contact us today to start the conversation.