Economic Outlook | August 2022

8/1/2022 12:00:00 PM

Have you ever heard the story about the 6-foot-tall statistician drowning while fording a stream with an average depth of 3 feet? (See Jeff Danziger’s famous cartoon on the “flaw of averages.”) It’s a challenge of most statistics that they can be used to illuminate or obfuscate nearly any situation, making things appear different than they really are.

If our attention is channeled in a particular direction, we might miss the bigger picture.

Underlying data is not always congruent with information coming through traditional sources. The Federal Reserve and economic forecasters tell us they expect to avoid a recession, because the consumer is in great shape. We don’t see it the same way. Rising delinquency rates on credit card debt, consumer loans, auto loans and cell phone bills all suggest the consumer is struggling in this environment of elevated inflation. We are also seeing signs of coming layoffs and hiring reductions.

Like the Flaw of Averages, missing the bigger picture may be the case in the stock market today. As of June 30, 2022, the year-to-date return for the S&P 500 was negative 20% – a discouraging number by any measure. Taking a broader view, over the last 3 years, the S&P 500 had an annualized return of 10.55%. The 5-year annualized return was 11.29%, and the 10-year return was 12.93%. In all of these cases, the return was above the index’s 9.43% annualized return since its inception in 1927.

What about bonds? This is an asset class that is supposed to moderate volatility from the stock market and cushion declines that occur in stocks. With bonds down 10% in the first half of the year, they were less volatile than stocks – but this is not the degree of acceptable tolerance generally associated with the bond market. To be sure, Deutsche Bank did a research piece that indicated this is the worst year so far for bonds since 1788.

Other asset classes like real estate, private equity and debt or precious metals didn’t help much, either.

If you are at the early stages of your investment life cycle, consider this selloff a blessing. Payday contributions to your 401(k) purchased more shares each time they occurred. This volatility also serves as a reminder early in your investment timeframe that having a portfolio allocation consistent with your personal investment profile and psychology is very important.

What is an investor supposed to do? As long as your investment allocation is built around reaching your long-term goals, leave things alone. Remember, your investment portfolio is like a bar of soap: the more you handle it, the smaller it gets.

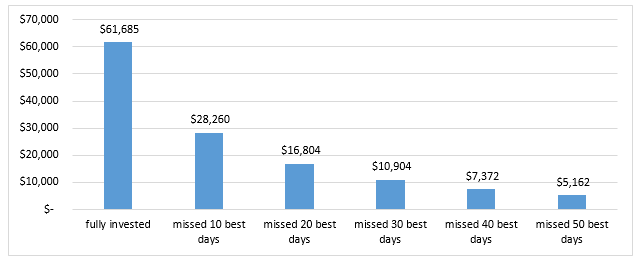

We often mention staying invested rather than trying to time the market. JP Morgan has a nice chart showing 20-year returns on a $10,000 investment in the S&P 500 from December 31, 2001, to December 31, 2021, and what it would mean if the best days in the market were missed.

Thank you for your business and confidence in Bell.

Investing and wealth management products are: Not FDIC Insured | No Bank Guarantee | May Lose Value | Not A Deposit | Not Insured by Any Federal Government Agency