IRS Raises Retirement Plan Contribution and Compensation Limits

1/20/2023 2:00:00 PM

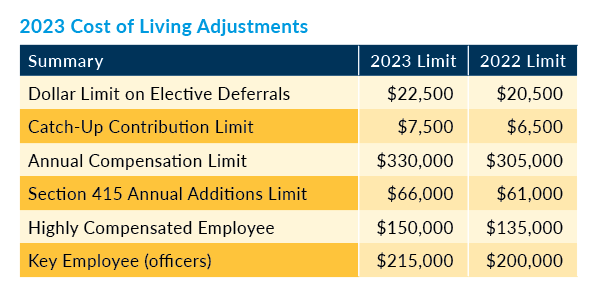

Each year, the Internal Revenue Service publishes updated dollar limitations for tax-qualified defined benefit and contribution plans. Since these limits are tied to overall inflation changes, we have become accustomed to modest annual increases. While no one likes to pay higher prices for goods and services, this is one silver lining of inflation.

Retirement plan participants looking for increased savings ability and higher compensation limits will be pleasantly surprised with the 2023 retirement plan contribution and compensation limits. For example, individual dollar limits on employee contributions into defined contribution plans increased $2,000 to $22,500 for 2023, and the catch-up contribution limit for those over age 50 increased $1,000 to $7,500 in 2023.

These are welcome adjustments for many who may be behind in saving for retirement.

Mike Kobbervig, CFP®, CEBS

SVP/Retirement Plan Services Division Manager

701-451-3033 | mkobbervig@bell.bank

Products and services offered through Bell Bank Wealth Management are: Not FDIC Insured | No Bank Guarantee | May Lose Value | Not a Deposit | Not Insured by Any Federal Government Agency