Tax Schedule

Tax Document Schedule for 2025 Tax Forms

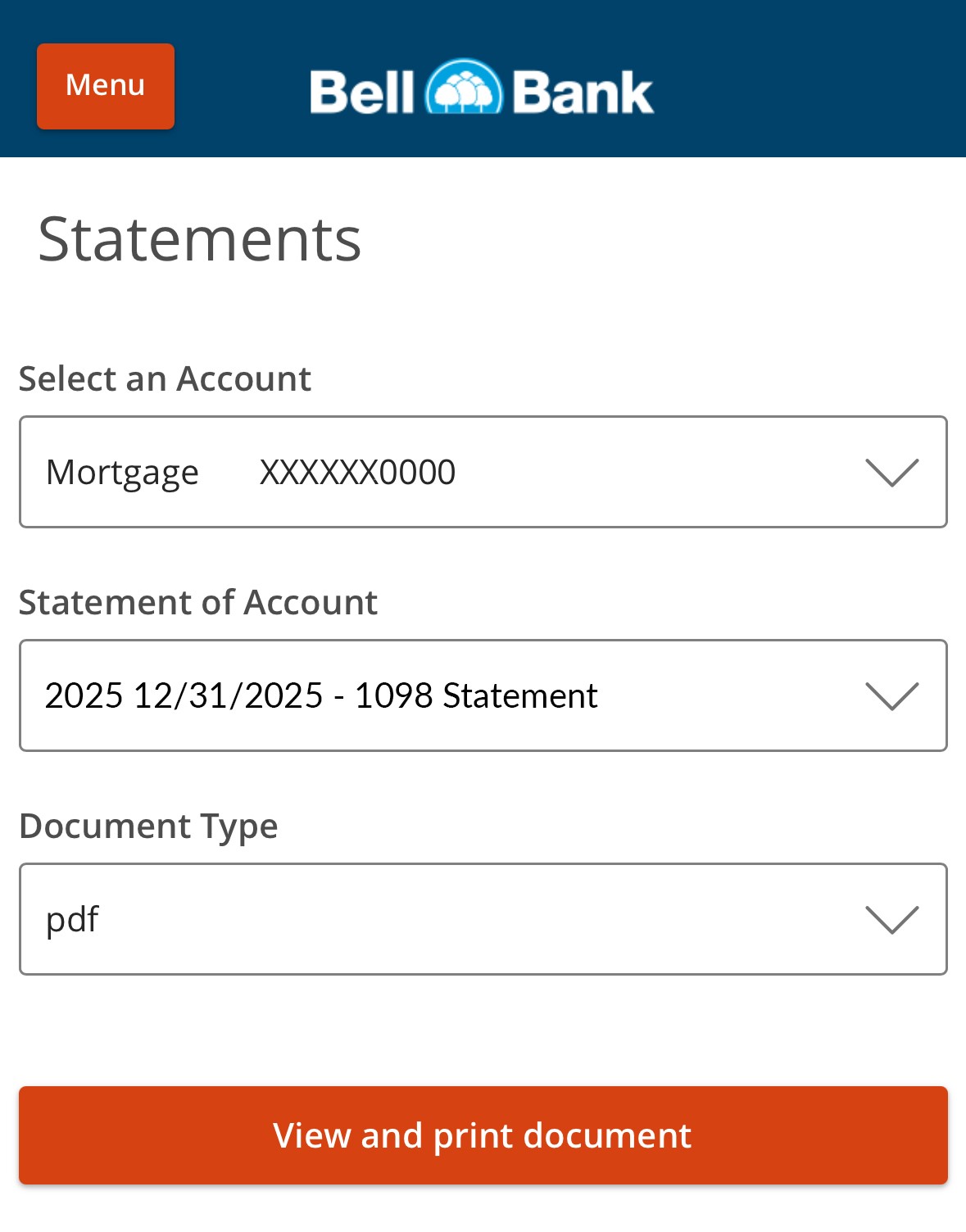

You can access year-end tax forms, 1099 INTs and 1098s, within mobile and online banking once they are ready.

Simply go to the statements page, choose your account and look for the tax document with a date of 12/31/2025.

Most tax documents will be mailed by January 31st, 2026. Refer to the tabs below for online and paper form availability dates specific to each document type.

1042 - S

1098

1099 Forms

5498 Forms

Business Loan Letter

Consumer Loan Letter

Fair Market Value Statement

Additional Information

The information contained on this website is for informational purposes only. Bell Bank does not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors for questions on your particular tax situation.