Bell Bank Frequently Asked Questions

The more you know about using your personal bank accounts, the more confident you’ll feel. Therefore, we’ve provided easy-to-access answers to commonly asked questions. If at any time you don’t find what you’re looking for, contact us and we’d be happy to assist.

Personal Banking FAQs

- Online: Apply online here. You will need your Social Security number, a government issued ID (such as a driver’s license, passport, state or military ID), and funds to open your account. Online, you can fund your new account with a credit card, debit card, or checking or savings account.

- At a branch: Stop by any of our bank locations. Make sure to bring your Social Security number, a government-issued photo ID and at least $50 in cash or a check to open your new account.

- Bell bank app.: If you are already a personal Bell Bank customer you can open an account by clicking the menu button in the upper left hand corner and then select “open an account

You can print your statement as a PDF from the File menu in personal online banking.

Go paperless by choosing Paperless Enrollment in the Statements tab within online banking, then choosing Paperless Statements as the Delivery Type.

You do not have to roll your change. If you are a Bell Bank customer, you can bring it to the bank, and we will count it for you.

Bell Bank offers Zelle®, a convenient way to send money right from your mobile banking app or online banking account, through personal online and mobile banking. Whether it’s saving you a trip to the ATM or taking the guesswork out of divvying up the cost of the lunch tab, Zelle® is a fast, safe and easy way to send and receive money to and from friends, family and others you know and trust1.

To start using Zelle®, log into your personal online banking as you always have. Then complete your quick, one-time enrollment in Zelle®. Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

1Must have a bank account in the U.S. to use Zelle®.

You can easily check your balance, find out whether a check cleared, transfer funds – and more – using personal online banking on desktop or the Bell Bank mobile app.

Your home page shows account balances at a glance. Clicking on an account gives you account details, so you can see which transactions are cleared or pending.

Transfer funds by choosing Transfers from the menu and following the simple steps.

If you are not yet enrolled, click here to sign up for personal online banking. To choose mobile banking, download our free Bell Bank smartphone app from your iPhone®, iPad® or Android™ app store, and log in using your personal online banking login and password.

It’s important to let us know if you change your address or phone number. You can call customer service at 1-800-450-8949 from 7 a.m. to 9 p.m. CT on weekdays or 8 a.m. to 5 p.m. CT on weekends (excluding major holidays). Or, send us a secure message through mobile and online banking.

To send us a message:

- Log in to your Bell Bank account on your computer or Bell Bank mobile app.

- Select “Menu,” then “Messages,” then “New Conversation.”

- Under “Select Recipient,” choose “Customer Service.”

- In the subject line, write: change of address or change of phone number, and in the message box, tell us what your new address or phone number is.

- Select “Send.”

Checking and Debit Card FAQs

We offer the option of ordering checks online, or you’re welcome to order in person or over the phone. You can:

- Order checks online by logging in to personal online banking, choosing Other from the menu and selecting Order Checks

- Call our customer service line at 1-800-450-8949. We have bankers available to help you from 7 a.m. to 9 p.m. Central Time weekdays and 8 a.m. to 5 p.m. Central Time on weekends (excluding some major holidays).

- Stop by any of our branches.

- Fill out the reorder slip at the back of your checkbook, mark any changes to your address, indicate how many boxes you want and whether you want single or duplicate checks, and drop it off at any Bell branch.

Mobile check deposits made by 7:30 p.m. CT will post at the end of the current business day. Deposits made on weekends, holidays, or after 7:30 p.m. CT will be processed at the end of the next business day.

Visit our personal banking help page to access comprehensive guides to personal online banking.

If you have the Bell Bank mobile app, you can use the “Manage Debit Cards” feature in the main menu to temporarily turn off your debit card. (If you don’t have the Bell Bank mobile app, you can learn about it here: Mobile Banking | Get Our Mobile Banking App | Bell Bank)

Next, call our customer service line right away at 1-800-450-8949. Customer service can help you restrict your card temporarily if you would like time to look for it, or we can close it and order you a new card.

Be sure to monitor online banking for any unauthorized charges, which you can dispute during business hours at a branch or over the phone.

Notify Bell Bank before traveling internationally if you will be using your debit card. Let us know where you are headed and the dates you will be traveling to help ensure that legitimate purchases are approved. You should also tell us the names of all cardholders who are traveling to make sure we modify each individual card that will be used internationally.

Review your cards’ expiration dates and ask about daily limits and cash withdrawal limitations. For debit card limit increases, you can call our customer service department at 1-800-450-8949. It’s also a good idea to double-check that your contact information on file with us is current to make it easier for us to contact you if necessary.

Be sure you have access to online banking before you leave. This will allow you to review transactions clearing your account, ask questions through secure message, and update your travel itinerary if applicable so cards are not flagged for potential fraudulent transactions.

Be sure you have access to your debit and credit cards through an online account. This will allow you to review transactions clearing your account, ask questions, and update your travel itinerary if applicable so cards aren't shut down or blocked for fraud.

Life sometimes comes with surprise expenses, which can lead to you inadvertently overdrawing your account. That can happen when you use your debit card for a transaction that exceeds your balance at the time the merchant sends the transaction for payment.

When you opened your account, you either authorized or did not authorize transactions that exceed your available balance. Depending on your selection, Bell may or may not decline the transaction. If the transaction is not declined, you could be charged an overdraft fee of $33.

Learn moreundefined about what this means and how you can avoid overdrafts.

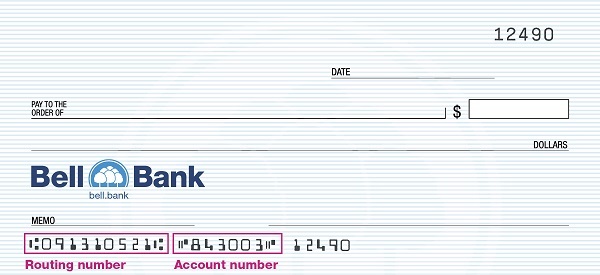

Bell Bank’s routing number is 091310521.

Here’s how to find your routing number, account number and check number. At the bottom of your check are 3 groups of numbers: your routing number, account number and check number.

Routing Number

The bank’s routing number is the first set of numbers in the lower left corner of your check. Routing numbers are 9-digit codes. The character symbol around the numbers is not part of the routing number on a check. Routing numbers are public and may vary by region.

Account Number

You’ll find your account number on your check immediately after the routing number. It’s the longer of the last 2 groups of numbers. Your account number is private and unique to your bank account. If you do not have checks to view your account number, please give us a call at 800-450-8949, or stop into a branch.

Check Number

The check number is usually the last set of numbers on your personal check. It’s also the shortest set of numbers on the check, typically 3 or 4 digits long. Your check number is not significant, except to help you keep track of which check you’re writing.

ChangeSaver FAQs

To participate in the Bell Bank ChangeSaver program you’ll need:

- A Bell Bank personal checking account with a debit card

- A Bell Bank savings account

Once you have a Bell Bank savings and checking account, there are 2 ways to sign up for ChangeSaver:

- Call 701-298-1550 to sign up by phone

- Stop by any Bell Bank location

*The 5% ChangeSaver match will be reported to the IRS on Form 1099MISC. The annual match limit is $250. You need to be enrolled in ChangeSaver and have your checking and savings account open on the last day of the year to receive your 5% match for the year. If you close either account before the end of the year, matching funds are forfeited.